WTI Crude Futures- Likely a Minor Pause

rhboskres

Publish date: Thu, 28 May 2020, 04:53 PM

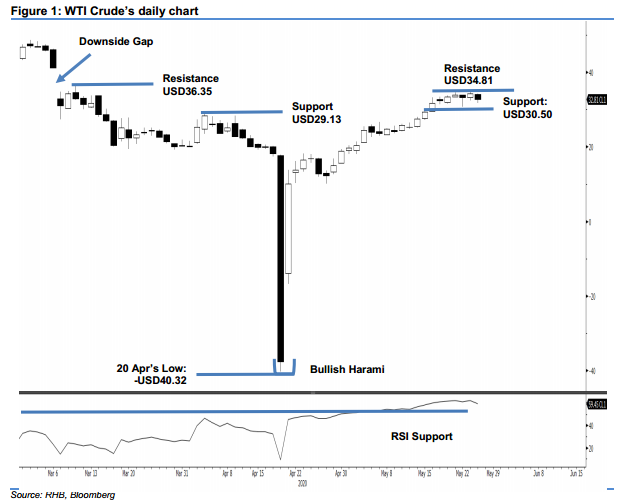

Maintain long positions. The WTI Crude ended the latest session USD1.54 weaker to settle at USD32.81. We observed the black gold undergoing a possible sideways consolidation phase over the recent sessions, with USD30.50 being the possible support level. This consolidation phase comes following the commodity’s sharp rebound, subsequent to 21 Apr’s “Bullish Harami” formation. Provided the aforementioned support is not breached, we believe the said rebound remains intact. We maintain our positive trading bias.

As the abovementioned consolidation resembles a possible sideways pattern for now, we maintain our long position recommendations while moving the trailing-stop loss to below the USD30.50 threshold. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is maintained at USD30.50, or the price point of 18 May. This is followed by USD29.13, which was the high of 3 Apr. Moving up, the immediate resistance is now pegged at USD34.81 – the high of 26 May – and followed by USD36.35, ie the high of 11 Mar.

Source: RHB Securities Research - 28 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024