FKLI- Crossing Immediate Resistance

rhboskres

Publish date: Fri, 29 May 2020, 05:01 PM

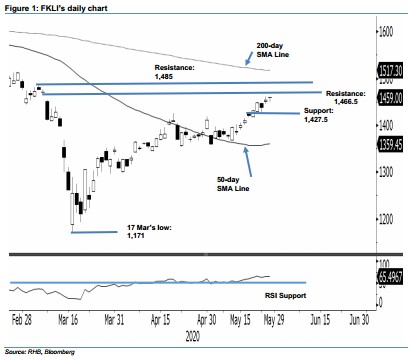

Maintain long positions as the bulls are still standing firm. The FKLI underwent a positive intraday price reversal from a low 1,449 pts to close at 1,459 pts, indicating a gain of 5.5 pts. The close also placed it above the previous immediate resistance of 1,454 pts. The index has been able to extend its rebound after it completed a consolidation phase around the 50-day SMA line, which took place between mid-April and mid-May. This positive bias is further supported by the 50-day SMA line, which is showing initial signs of curving upwards. Premised on this, we are maintaining our positive trading bias.

We advise that traders stay in long positions. We initiated these at 1,421.5 pts, the closing level of 19 May. To manage risks, a stop-loss can now be placed at below 1,427.5 pts.

We revise the immediate support to 1,445 pts, the price point of 27 May, this is followed by 1,427.5 pts, the low of 22 May. Meanwhile, the immediate resistance is now at 1,466.5 pts – the “Downside Gap” of 6 Mar, followed by 1,485 pts, the high of 5 March.

Source: RHB Securities Research - 29 May 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024