FKLI - Fills Downside Gap

rhboskres

Publish date: Mon, 01 Jun 2020, 10:30 AM

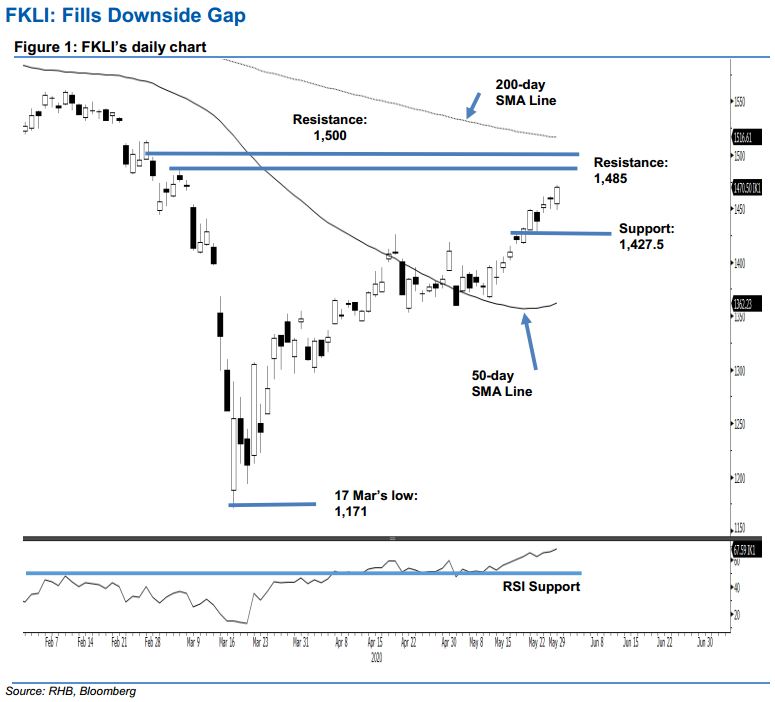

Maintain long positions. The FKLI’s positive momentum remained in place last Friday, and the index closed 12 pts stronger at 1,471 pts – filling 6 Mar’s “Downside Gap”. The positive session is a continuation of the index’s rebound, following the completion of its consolidation phase around the 50-day SMA line between mid-April and mid-May. Meanwhile, the RSI reading is still below the overbought threshold. Based on the latest technical picture, provided the 1,427.5-pt support level not breached, the risk of the index undergoing a retracement should still be contained. We maintain our positive trading bias.

With the index filling the said “Downside Gap” and not showing a possible price rejection, traders should stay in long positions. We initiated these at 1,421.5 pts, the closing level of 19 May. To manage risks, a stop-loss can now be placed below 1,427.5 pts.

The immediate support remains at 1,445 pts, the price point of 27 May, followed by 1,427.5 pts, the low of 22 May. Moving up, the immediate resistance is now at 1,485 pts, the high of 5 March, followed by 1,500-pt mark.

Source: RHB Securities Research - 1 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024