FCPO - Negative Intraday Price Reversal

rhboskres

Publish date: Mon, 01 Jun 2020, 10:33 AM

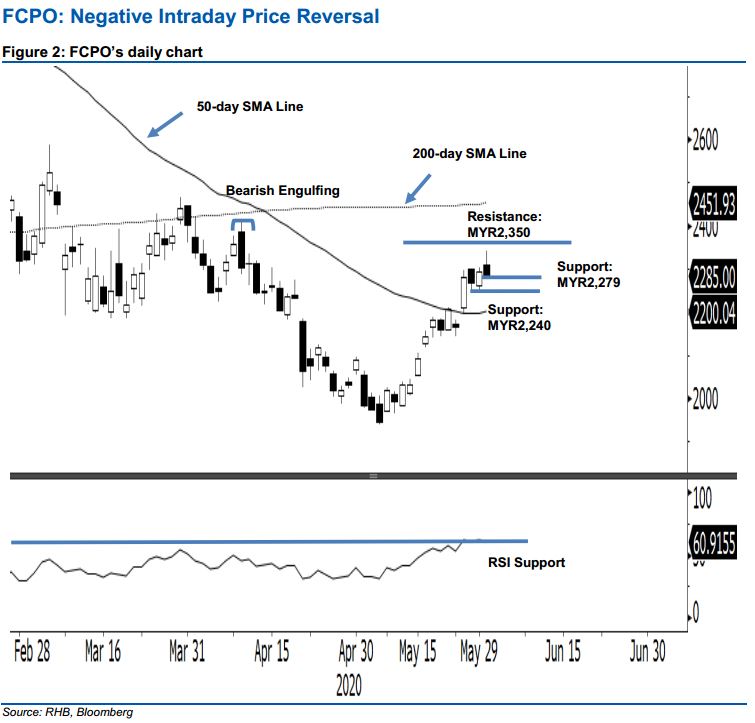

Maintain long positions while tightening up risk management. The FCPO underwent a negative price reversal, slipping from a high of MYR2,341 to close at MYR2,285 yesterday – indicating a decline of MYR7.00. The negative price reversal happened after the commodity briefly crossed above the MYR2,300 immediate resistance and came in not too far to test the second resistance of MYR2,350 during the session – both are negative observations. Should the latest low be breached in the coming sessions, this could signal that the commodity’s near 3-week rebound is headed for a correction. Pending this, we are maintaining our positive trading bias.

Until a retracement phase sets in, we advise traders to stay in long positions. We initiated these at MYR2,032, the closing level of 13 May. To manage risks, a stop-loss can now be placed below MYR2,279.

We revise the immediate support to MYR2,279 – the latest low. This is followed by MYR2,240, the price point of 27 May. Meanwhile, the immediate resistance is set at MYR2,300 mark, followed by MYR2,350.

Source: RHB Securities Research - 1 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024