E-mini Dow Futures - No Sign of Price Exhaustion

rhboskres

Publish date: Mon, 01 Jun 2020, 10:38 AM

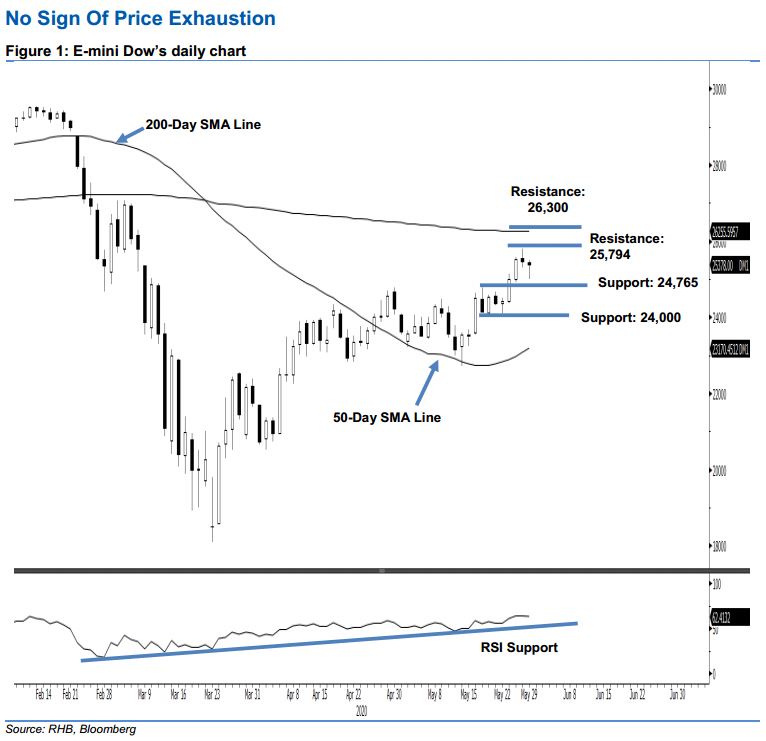

Maintain long positions while moving up the trailing-stop. The E-mini Dow ended the latest session marginally lower by 79 pts to 25,378 pts after rebounding from an intraday low of 24,991 pts. Consequently, a “Hammer” formation appeared. Said formation indicates that the bulls are still having firm control over the index’s rebound, which resumed after it underwent a sideways correction phase between 3 Apr and 14 May around the 50-day SMA line. The upward move remains healthy, with an RSI reading of 62.4. This is further supported by the aforementioned SMA line, which is showing signs of curving upwards. We maintain our positive trading bias.

Hence, we advise traders to stay long, following our recommendation of initiating long above the 24,000-pt level on 19 May. A stop-loss can now be set below the 24,000-pt level.

The immediate support is revised to 24,765 pts, the high of 19 May. This is followed by the 24,000-pt round figure. Conversely, the immediate resistance is eyed at 25,794 pts, ie the high of 28 May. This is followed by 26,300 pts – a level near the 200-day SMA line.

Source: RHB Securities Research - 1 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024