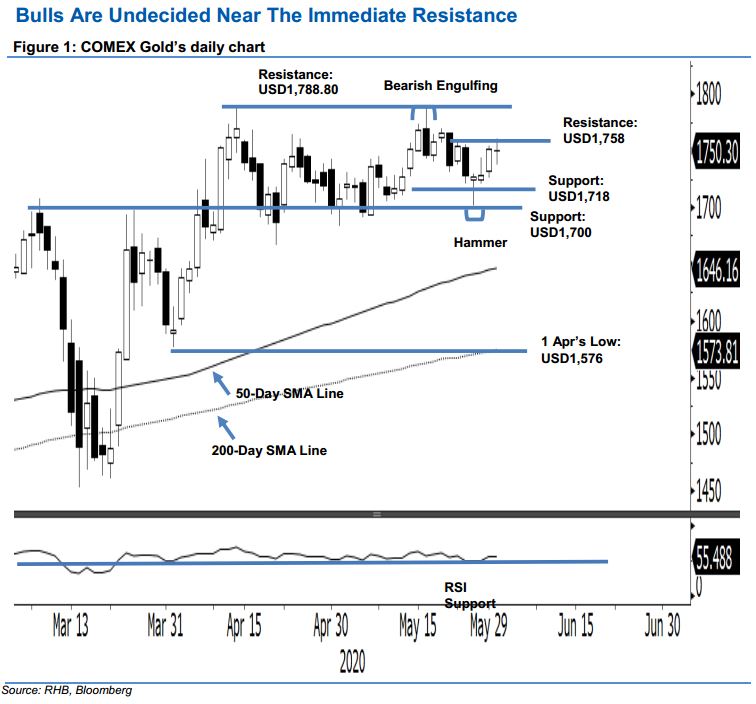

COMEX Gold - Bulls Are Undecided Near the Immediate Resistance

rhboskres

Publish date: Tue, 02 Jun 2020, 10:41 AM

Maintain short positions, as the correction phase may still be extending. The COMEX Gold ranged between USD1,737.60 and USD1,761.00 before closing USD1.40 lower at USD1,750.30. Consequently, a “Doji” formation appeared – indicating indecisiveness by the bulls near the USD1,758 immediate resistance. Looking at the broader picture, chances are high that the correction phase, which started following the price rejection from an area near the USD1,788.80 resistance – a multi-year high – may still be extending. Towards the downside, a breach of the USD1,700 resistance-turned-support level could open the door for further weakness. We maintain our negative trading bias.

As the commodity has yet to bail out to signal an end to the abovementioned correction phase, we advise traders to stay in short positions. We initiated these on 21 May after the COMEX Gold crossed below the USD1,741.90 mark. For risk-management purposes, a stop-loss can be placed above the USD1,758 level.

The immediate support is maintained at USD1,718 – the price point of 27 May – and followed by USD1,700. Moving up, the immediate resistance is eyed at USD1,758, or the high of 22 May. This is followed by the USD1,788.80 level, ie the high of 14 Apr.

Source: RHB Securities Research - 2 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024