WTI Crude Futures - No Exhaustion Yet

rhboskres

Publish date: Tue, 02 Jun 2020, 10:42 AM

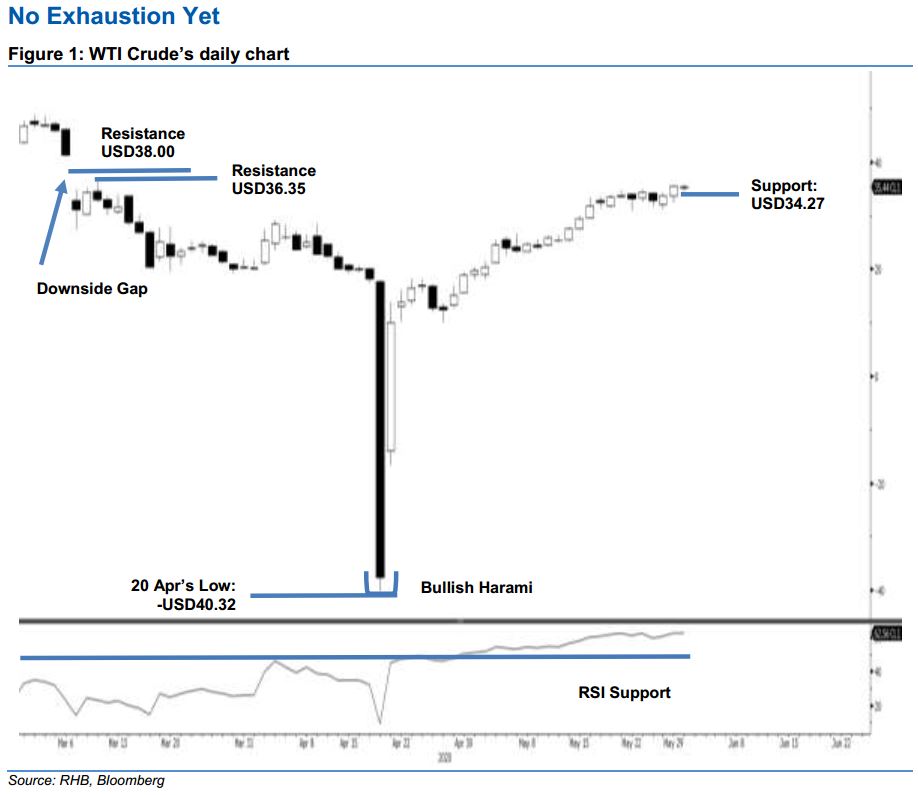

Maintain long positions while tightening up the risk management. The WTI Crude ended marginally lower by USD0.05 to close at USD35.44 after trading in a range between USD34.27 and USD35.90. The latest performance can be seen as a mild profit-taking session following the commodity’s upside breach of the previous USD34.81 immediate resistance during the prior session. Looking at the trend, the WTI Crude’s rebound – following the historic washout session on 20 Apr – is still not showing an exhaustion signal, while the RSI remains below the overbought threshold. We maintain our positive trading bias.

As the commodity has breached the previous 1-week sideways consolidation phase – though not significantly, we maintain our long position recommendations while moving the trailing-stop loss to below the USD32.20 threshold. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is revised to USD34.27, ie the latest low. This is to be followed by USD32.20, or near 29 May’s low. Moving up, we are now eying the immediate resistance at USD36.35 – the high of 11 Mar – and followed by the USD38.00 mark.

Source: RHB Securities Research - 2 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024