FKLI - At The 1,500-pt Mark

rhboskres

Publish date: Wed, 03 Jun 2020, 10:11 AM

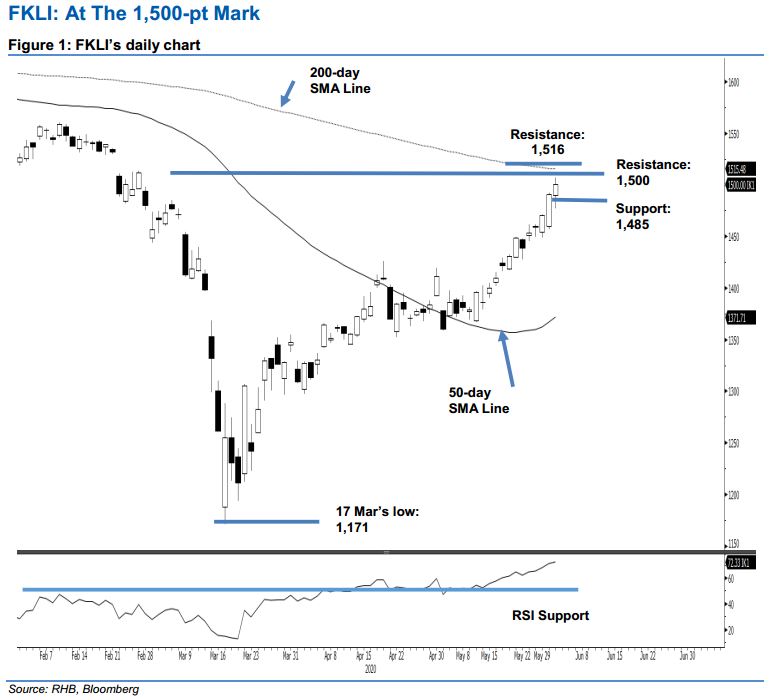

Maintain long positions, while further ramping up risk management. The FKLI underwent a positive intraday price reversal to close at the multi-year support-turned-resistance mark of 1,500 pts yesterday. At one point, it reached a high of 1,507 pts. This indicates the lack of a price rejection from 1,500 pts, and implies that the overall rebound that started from the low of 1,171 pts on 17 Mar is still firmly in place. Towards the downside, as long as the 1,485-pt support is not breached southwards, the risk of a retracement developing is still contained. Premised on this, we maintain a positive trading bias.

In the absence of a price exhaustion signal from the 1,500-pt mark, traders should stay in long positions. We initiated these at 1,421.5 pts, the closing level of 19 May. To manage risks, a stop-loss can now be placed below 1,485 pts.

We revise the immediate support to 1,485 pts – the price point of the latest session. This is followed by 1,475 pts – derived from 1 Jun’s candle. Moving up, the immediate resistance is maintained at the 1,500-pt mark, followed by 1,516 pts – the current reading of the 200-day SMA line.

Source: RHB Securities Research - 3 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024