E-Mini Dow - Prepping for a Rebound Extension

rhboskres

Publish date: Wed, 03 Jun 2020, 10:13 AM

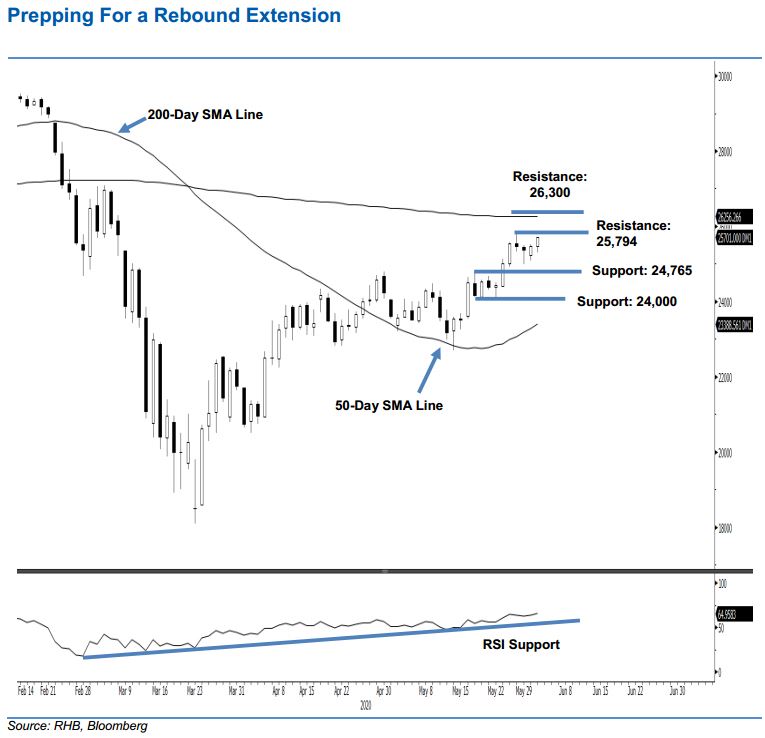

Maintain long positions, as the rebound seems to be staging for an extension. The E-mini Dow formed a second consecutive white candle to end 238 pts higher at 25,701 pts. Price actions over the latest four sessions indicate that – following its previous upward move – the chances of the index undergoing a relatively narrow consolidation are high. This consolidation phase is taking place below the 200-day SMA line. The RSI reading is still trending up, but remains below the overbought threshold. Hence, we maintain our positive trading bias.

As the aforementioned consolidation is deemed healthy – ie it is not showing signs of turning into a deeper retracement – we advise traders to stay long. This follows our recommendation of initiating long above the 24,000- pt level on 19 May. A stop-loss can now be set below the 24,765-pt threshold.

The immediate support is maintained at 24,765 pts, or the high of 19 May. This is followed by the 24,000-pt round figure. Conversely, the immediate resistance is eyed at 25,794 pts, ie the high of 28 May. This is followed by 26,300 pts – a level near the 200-day SMA line.

Source: RHB Securities Research - 3 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024