WTI Crude Futures- Rebound Carrying on

rhboskres

Publish date: Thu, 04 Jun 2020, 04:34 PM

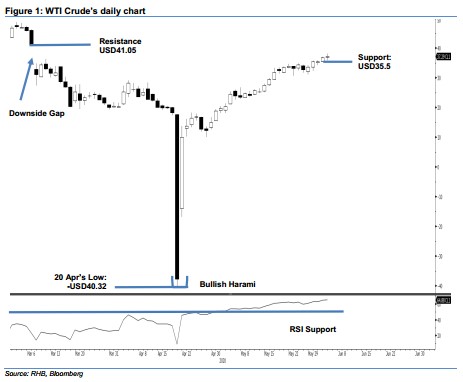

Maintain long positions, but with a higher trailing-stop. Despite not being able to hold on to a large portion of its intraday gains, the WTI Crude ended the latest session USD0.48 stronger at USD37.29 – the high was at USD38.18. We are not seeing a possible price rejection signal from the USD38.00 immediate resistance point in the latest session. The RSI reading, while heading up, is still below the overbought threshold. Based on the latest technical picture, the risk for the commodity to experience a retracement would be contained provided the USD34.20 support level is not breached. Maintain our positive trading bias.

We maintain our long position recommendations while moving the trailing-stop loss to below the USD34.20 threshold. These positions were initiated at USD15.06, or the closing level of 29 Apr.

The immediate support is revised to USD35.50 – near the latest low. This is followed by USD34.20 – near the low of 1 Jun. Conversely, the immediate resistance is eyed at USD38.00, followed by USD41.05 – the “Downside Gap” of 6 Mar.

Source: RHB Securities Research - 4 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024