COMEX Gold- Bulls Are Rejected From Immediate Resistance

rhboskres

Publish date: Thu, 04 Jun 2020, 04:36 PM

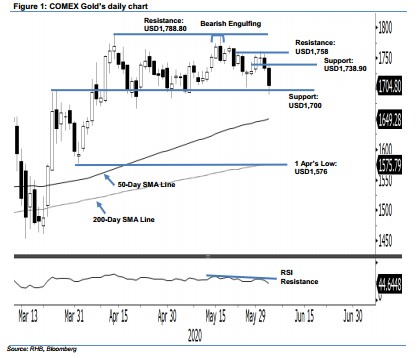

Correction phase is still incomplete; maintain short positions. The COMEX Gold experienced a negative intraday price reversal. Prices slid from a high of USD1,738.90 to briefly test the USD1,700 support mark with a low of USD1,690.30 – before closing at USD1,704.80. The negative session came after the yellow metal attempted to cross above the USD1,758 resistance on 1 Jun – signalling a price rejection. By extension, this means the correction phase that started following 18 May’s “Bearish Engulfing” formation is still incomplete and likely to extend. Towards the downside, a breach of the USD1,700 support mark could open the space for further weakness. Maintain our negative trading bias.

We advise traders to stay in short positions. We initiated these on 21 May after the COMEX Gold crossed below the USD1,741.90 mark. For risk-management purposes, a stop-loss can be placed above the USD1,758 level.

We revised the immediate support to the USD1,700 round figure. This is followed by USD1,690.30 – the latest low. Towards the upside, the immediate resistance is eyed at USD1,738.90 – the latest high, followed by USD1,758, or the high of 22 May.

Source: RHB Securities Research - 4 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024