FKLI- Piercing Through The Resistance Zone

rhboskres

Publish date: Thu, 04 Jun 2020, 04:38 PM

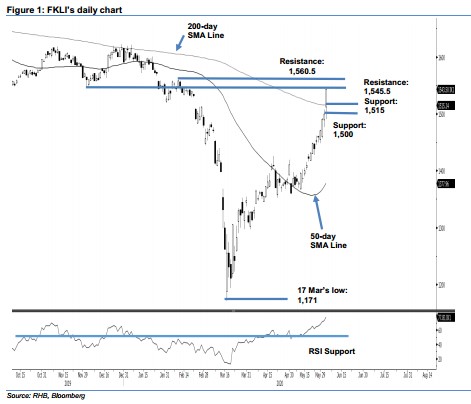

Maintain long positions while moving up trailing-stop. The FKLI staged a strong performance as it crossed above the resistance zone that comprised of the multi-year support-turned-resistance level of 1,500 pts and the 200-day SMA line. Intraday, the tone was positive as the index generally trended up from a low of 1,490.5 pts to settle at 1,543.5 pts – a 43.5-pt gain. Despite the RSI reading is now at an overbought level and the recent upward move becoming less healthy ie too sharp a rise without pausing, price signals continued to indicate that the bulls are still in firm control. Premised on this, we are keeping our positive trading bias.

As the index has convincingly crossed above the said resistance zone, traders should stay in long positions. We initiated these at 1,421.5 pts, the closing level of 19 May. To manage risks, a stop-loss can now be placed below 1,500 pts.

We revise the immediate support to 1,515 pts – near the 200-day SMA line. This is followed by the 1,500-pt mark. Meanwhile, immediate resistance is now pegged at 1,545.5 pts – the low of 3 Dec 2019, this is followed by 1,560.5 pts, the high of 11 Feb.

Source: RHB Securities Research - 4 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024