FCPO- Potential Price Reversal Signal

rhboskres

Publish date: Fri, 05 Jun 2020, 04:41 PM

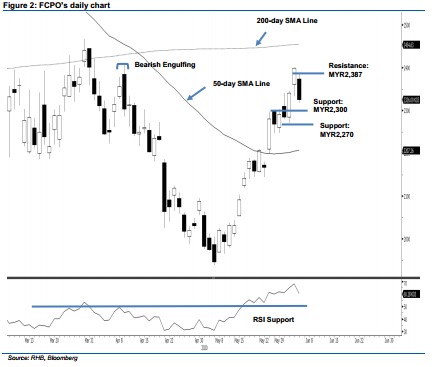

Maintain long positions pending price reversal confirmation. The FCPO ended the latest trade on a weak tone, ceding MYR73 to close at MYR2,326 and breaching the previous immediate support of MYR2,350. The negative performance set in after the commodity came close to test the MYR2,409 resistance mark in the prior session – this can be seen as a potential price reversal signal. However, to confirm this, we are of the view that the MYR2,300 support mark needs to be breached by the bears. If that happens, it could potentially lead to a price retracement phase. Pending this, we are keeping our positive trading bias.

Pending further negative price actions to mark an end to the near 4-week rebound, we advise traders to stay in long positions. We initiated these at MYR2,032, the closing level of 13 May. To manage risks, a stop-loss can be placed below MYR2,300.

We revise the immediate support to MYR2,300, this is followed by MYR2,270 – the low of 2 Jun. Towards the upside, the immediate resistance is now set at MYR2,387 – the latest high. This is followed by MYR2,409 – the high of 9 Apr’s “Bearish Engulfing” pattern

Source: RHB Securities Research - 10 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024