COMEX Gold: Moving Down the Trailing-Stop

rhboskres

Publish date: Tue, 09 Jun 2020, 01:12 PM

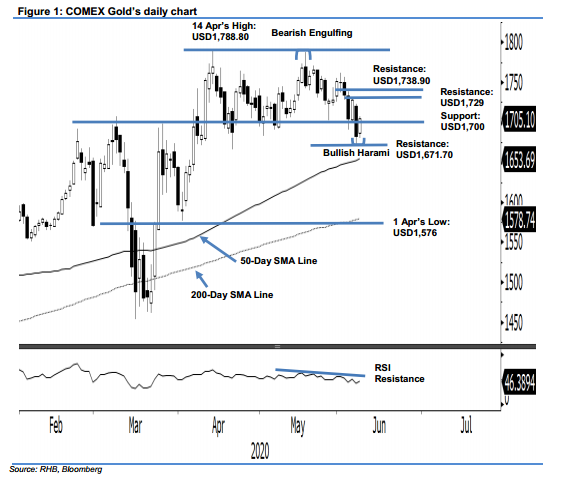

Maintain short positions. The COMEX Gold ended the latest trade USD22.10 stronger at USD1,705.10. The positive closing placed the commodity back above the USD1,700 mark and, consequently, a “Bullish Harami” formation appeared. This can be seen as an attempt by the bulls to regain control over the price trend. However, to confirm that the multi-week correction phase – which started from the high of USD1,788.80 on 14 Apr – has completed, further positive price actions in the coming sessions are needed. Pending this, we are keeping our negative trading bias.

As we have yet to see the signal to mark the completion of the ongoing correction phase, we advise traders to stay in short positions. We initiated these on 21 May after the COMEX Gold crossed below the USD1,741.90 mark. For risk-management purposes, a stop-loss can be placed at the breakeven level.

We keep the immediate support at a round figure of USD1,700. This is followed by USD1,671.70 – the low of 5 June. Meanwhile, the immediate resistance is pegged at USD1,729, which was the high of 4 June. This is followed by USD1,738.90, or the high of 3 Jun.

Source: RHB Securities Research - 9 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024