WTI Crude Futures: Tightening Up Risk Management

rhboskres

Publish date: Tue, 09 Jun 2020, 01:13 PM

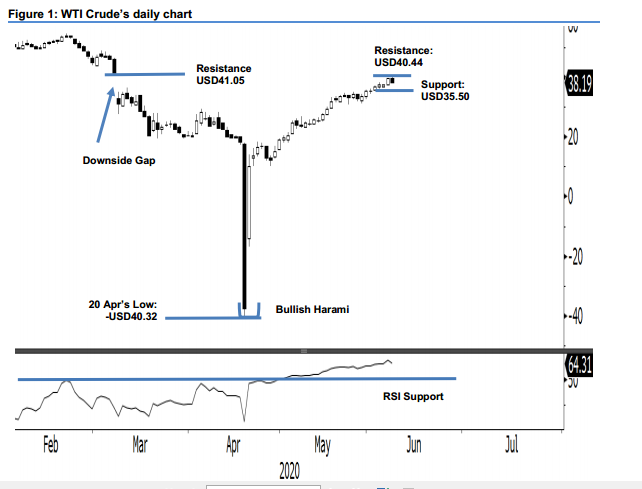

Maintain long positions. The WTI Crude experienced a negative price reversal as it slid from a high of USD40.44 to close at USD38.19 – a decline of USD1.36. This reversal took place after the commodity partially filled 6 Mar’s “Downside Gap”. However, this is insufficient to signal the rebound, which started following the historic washout session on 20 Apr, is due for a deeper and lengthy correction phase. For now, the possibility of this happening should only increase if the USD35.50 support mark is breached. We maintain our positive trading bias.

Pending a price signal for a correction phase to set in, we maintain our long position recommendation while moving the trailing-stop loss to below the USD35.50 threshold. These positions were initiated at the USD15.06 mark, or the closing level of 29 Apr.

The immediate support is maintained at USD35.50 – near the low of 3 June. This is followed by USD34.20, which was the low of 1 Jun. Meanwhile, the immediate resistance is now set at USD40.44, or the latest high. This is to be followed by USD41.05 – the “Downside Gap” of 6 Mar.

Source: RHB Securities Research - 9 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024