FKLI - 9 June 2020

rhboskres

Publish date: Tue, 09 Jun 2020, 01:15 PM

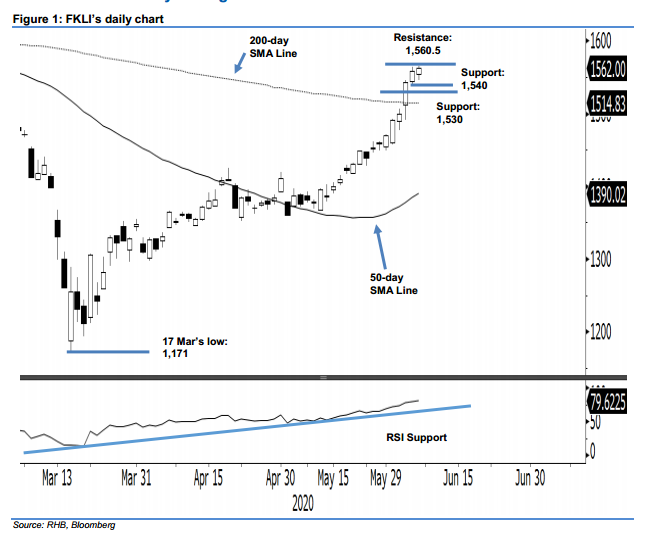

Maintain long positions while moving up trailing stop further. The FKLI’s positive price momentum continued to extend. It managed to reverse from its earlier session’s loss to end 4 pts higher at 1,562 pts – crossing above the previous immediate resistance of 1,560.5 pts. While the RSI is overbought, price actions over the latest two sessions – following the upside breach of the previous critical resistance zone made up of the 1,500-pt and the 200-day SMA line – are indicating the rebound that resumed following the completion of a correction phase that took place around the 50-day SMA line between mid-Mar and mid-Apr remains firmly in place. Premised on this, we are keeping our positive trading bias.

In the absence of a price reversal signal, traders are advised to stay in long positions. We initiated these at 1,421.5 pts, the closing level of 19 May. To manage risks, a stop-loss can now be placed below 1,540 pts.

We keep the immediate support target at 1,540 pts, the price point of 4 May. This is followed by the 1,530-pt mark – derived from 3 Jun’s candle. Meanwhile, the immediate resistance is now eyed at 1,566.5 pts – derived from 24 Jan’s “Downside Gap”, followed by 1,580 pts.

Source: RHB Securities Research - 9 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024