WTI Crude- Still Looks Like a Minor Pause

rhboskres

Publish date: Thu, 11 Jun 2020, 06:13 PM

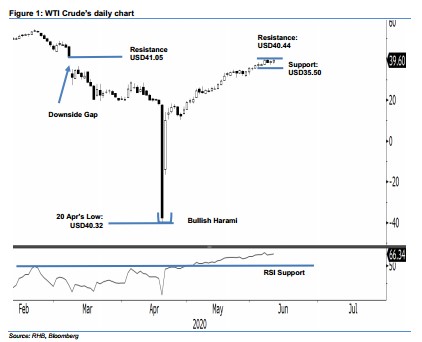

Maintain long positions while placing the trailing-stop tighter. The WTI Crude ended the latest session

USD0.66 higher at USD39.60. The commodity’s price actions over the past three sessions indicate that a minor

pause is likely developing, after it partially filled 6 Mar’s “Downside Gap” with the recent high of USD40.44. This is

deemed as a healthy development. However, should the USD37.00 immediate support be breached, we believe

there will be higher risk of a deeper and lengthy correction phase to set in. For now, we keep our positive trading

bias.

Without clear signs for a retracement to kick in, we maintain our long position recommendation while moving the

trailing-stop loss to below the USD37.00 threshold. These positions were initiated at the USD15.06 mark, or the

closing level of 29 Apr.

The immediate support is revised to USD37.00, which is near the low of 9 Jun. This is followed by USD35.50 –

close to the low of 3 June. Moving up, the immediate resistance is eyed at USD40.44, which is the latest high. This

is followed by USD41.05 – the “Downside Gap” of 6 Mar.

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024