FKLI- Triggers Reversal Signa

rhboskres

Publish date: Fri, 12 Jun 2020, 05:02 PM

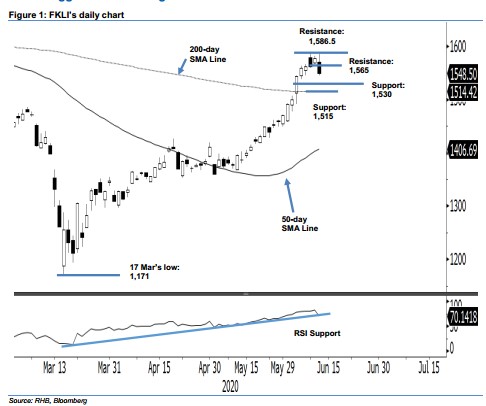

Initiate short positions, as the rebound may have reached an interim top. The FKLI underwent a negative intraday reversal, after it failed to test the 1,586.5-pt resistance yesterday. It shed 28.5 pts to settle at 1,548.5 pts, crossing below the previous immediate support of 1,550 pts. This happened after the index’s recent surge turned unhealthy, with the RSI crossing the overbought threshold. We believe the index has entered into a consolidation phase, to correct the rebound that started from the low of 1,171 pts, on 17 Mar. Premised on this, we switch our trading bias to negative.

Our previous long positions – initiated at 1,421.5 pts, the closing level of 19 May – were negated at 1,550 pts. On the bias a correction phase has just set in, we initiate short positions at the latest close. To manage risks, a stop-loss can be placed above 1,586.5 pts.

We revise the immediate support to 1,530 pts, the price point of 3 Jun. This is followed by 1,515 pts, which is near the 200-day SMA line. Conversely, the immediate resistance is now at 1,565 pts, the price point of the latest session, then 1,586.5 pts – the high of 9 Jun.

Source: RHB Securities Research - 12 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024