FCPO- Bouncing Off Near Support Level

rhboskres

Publish date: Fri, 12 Jun 2020, 05:06 PM

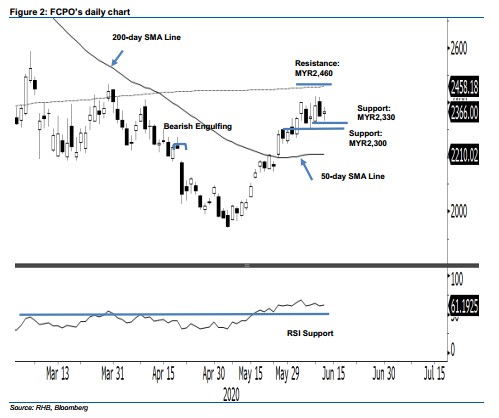

Maintain long positions, as there is still no confirmation of a reversal. The FCPO reversed its earlier session’s weakness, and hit a low of MYR2,332 yesterday before rebounding to settle MYR19.00 higher at MYR2,368. The positive price reaction from an area near the immediate support of MYR2,330 means there is still no price confirmation to indicate that the commodity’s 4-week rebound is due for a deeper correction. This was despite its recent sessions’ negative price reactions in the resistance zone of MYR2,409 and MYR2,460 – which happened on the back of a decelerating momentum. Hence, we are maintaining our positive trading bias.

Traders should stay in long positions. We initiated these at MYR2,032, the closing level of 13 May. To manage risks, a stop-loss can be placed below MYR2,330.

We are keeping the immediate support at MYR2,330, near the low of 9 Jun. This is followed by MYR2,300. Conversely, the immediate resistance is pegged at MYR2,409, the high of 9 Apr’s “Bearish Engulfing” pattern. This is followed by MYR2,460, which is close to the 200-day SMA line.

Source: RHB Securities Research - 12 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024