Hang Seng Index Futures- a Possible False Breakout

rhboskres

Publish date: Mon, 15 Jun 2020, 09:48 AM

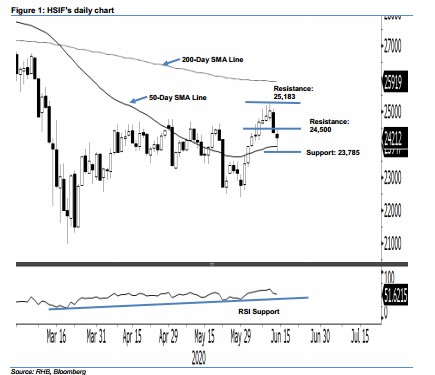

Remain in short positions, as the risk of a false breakout is high. The HSIF managed to significantly narrow its losses during the latest session. It settled 154 pts lower at 24,212 pts after testing the 50-day SMA line with a low of 23,785 pts. The negative session can be seen as a continuation from the prior session’s sharp decline, which saw the index fall back below the previous 24,600-24,800 pts breakout zone, suggesting that the risk of a false breakout is high. Towards the downside, a breach of the 50-day SMA line should further enhance this negative bias.

Our previous long positions, initiated at 24,243 pts on 26 May, were closed out at the latest session at breakeven levels. Concurrently, we initiate short positions at the latest closing mark. For risk-management purposes, a stoploss can now be placed at above the 25,183-pt threshold.

The immediate support is revised to 23,785 pts, which was the latest low. This is followed by the 23,500-pt mark. Towards the upside, the immediate resistance is now pegged at 24,500 pts and followed by 25,183 pts – the high of 9 Jun.

Source: RHB Securities Research - 15 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024