FCPO- Bulls Still Reluctant To Let Go

rhboskres

Publish date: Mon, 15 Jun 2020, 10:03 AM

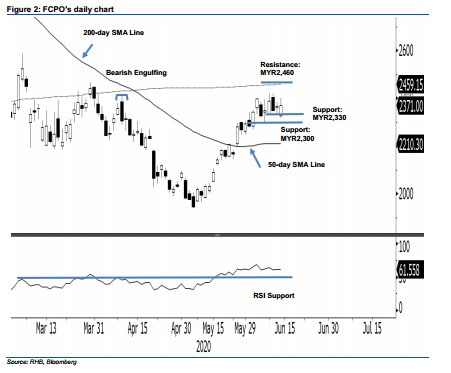

Maintain long positions The FCPO staged a positive intraday price reversal, rebounding from a low of MYR2,316 to close MYR5.00 higher, at MYR2,371. This happened after the MYR2,330 immediate support was briefly tested – indicating that the bulls are still in action. Despite the fading momentum – based on the commodity’s price actions and trading pattern developed in recent sessions – the commodity may likely extend its rebound to test the 200-day SMA line. Premised on this, we make no change to our positive trading bias.

As the bulls are trying to extend the FCPO’s 5-week rebound, traders should remain in long positions. We initiated these at MYR2,032, the closing level of 13 May. To manage risks, a stop-loss can be placed below MYR2,330.

The immediate support is still pegged at MYR2,330, near the low of 9 Jun. This is followed by MYR2,300. Meanwhile, overhead resistance is set at MYR2,409, the high of 9 Apr’s “Bearish Engulfing” pattern. This is followed by MYR2,460, which is close to the 200-day SMA line.

Source: RHB Securities Research - 22 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024