COMEX Gold- Still Trading in a Consolidation Phase

rhboskres

Publish date: Tue, 16 Jun 2020, 10:02 AM

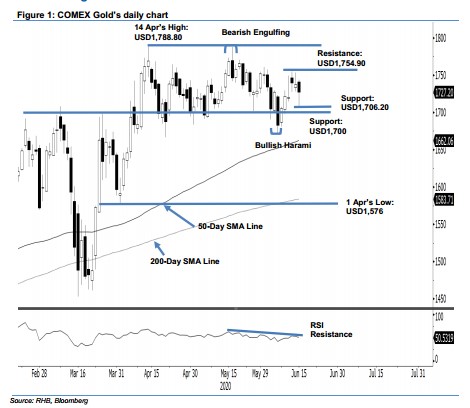

Maintain short positions, as the bulls still failed to break away from the consolidation phase. The COMEX Gold experienced a negative price reversal, sliding from a high of USD1,743.80 to close at USD1,727.20. The weak performance still suggests no firm follow up to 8 Jun’s “Bullish Harami” formation to signal an end to its multi-week correction phase. Towards the upside, we now believe an upside breach of the USD1,754.90 resistance mark could signal an end to said correction phase. Pending this, we are keeping to our negative trading bias.

We advise traders to stay in short positions. We initiated these on 21 May after the COMEX Gold crossed below the USD1,741.90 mark. For risk-management purposes, we revise our stop-loss to above the USD1,754.90 threshold.

The immediate support is now eyed at USD1,706.20 – the latest low – and followed by the USD1,700 level. Moving up, the immediate resistance is now pegged at the USD1,745.00 mark, which was near the latest high. This is followed by USD1,754.90, or the high of 11 Jun.

Source: RHB Securities Research - 16 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024