Hang Seng Index Futures - Lingering Around The 50-day SMA Line

rhboskres

Publish date: Wed, 17 Jun 2020, 04:50 PM

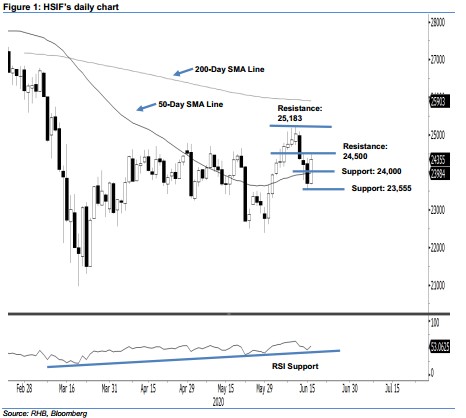

Maintain short positions, as the risk is still tilted towards the downside. The HSIF performed strongly in the latest session – adding 653 pts to close at 24,355 pts – back above the 50-day SMA line. Looking at the index’s price actions over the two latest sessions, we believe the retracement phase is experiencing a minor pause around the said SMA line. This comes following its sharp decline from the recent high of 25,183 pts. Hence, we are keeping our negative trading bias.

As we see the retracement phase as still incomplete, we advise traders to stay in short positions. We initiated these at 24,212 pts – the closing level of 12 Jun. For risk-management purposes, a stop-loss can now be placed at above the 25,183-pt threshold.

The immediate support is revised to 24,000 pts, a round figure near the 50-day SMA line. This is followed by 23,555 pts – the low of 15 Jun. Conversely, the immediate resistance is maintained at 24,500 pts, and followed by 25,183 pts, which was the high of 9 Jun.

Source: RHB Securities Research - 17 Jun 2020