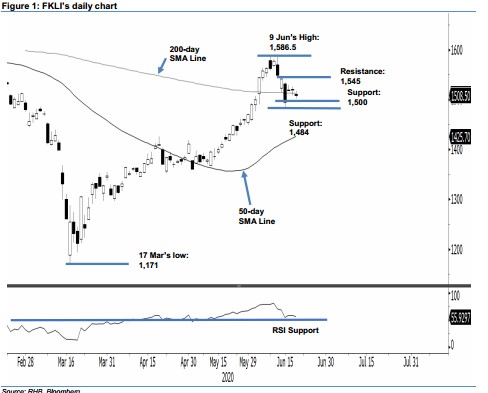

FKLI- Back Below 200-day SMA Line

rhboskres

Publish date: Fri, 19 Jun 2020, 04:42 PM

Maintain short positions as support zone is again under threat. The FKLI closed 11 pts weaker at 1,508.5 pts yesterday, after charting a low 1,502.5 pts. The closing level pushed the index dangerously back to the lower boundary of the 1,500-1,515pts support zone. A firm breach of this zone could open up room for further weakness for the index. All in, we believe the FKLI is developing a multi-week correction phase, after hitting a high of 1,586.5 pts on 9 Jun. We maintain our negative trading bias.

Traders should remain in short positions. We initiated these at 1,548.5 pts – the closing level of 11 Jun. To manage risks, a stop-loss can be set above 1,560-pts.

The immediate support is pegged at the 1,500-pt mark. This is followed by 1,484 pts, the low of 15 Jun. Conversely, the immediate resistance is at 1,545 pts, derived from 12 Jun’s candle, followed by 1,565 pts, the price point of 11 Jun.

Source: RHB Securities Research - 19 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024