FCPO - Minor Profit Taking

rhboskres

Publish date: Tue, 23 Jun 2020, 09:15 AM

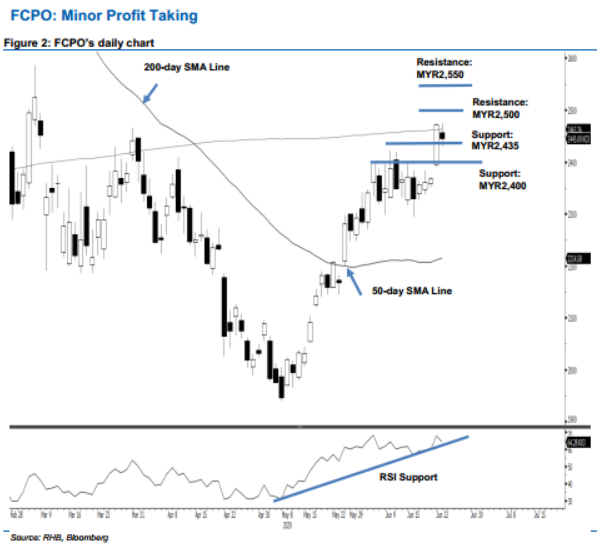

Maintain long positions as the bulls are merely taking a pause. The FCPO ended the latest trade MYR27 lower at MYR2,445 – this was after it swung between a low and high of MYR2,430 and MYR2,475. The closing level placed the soft commodity back below the 200-day SMA line. Despite this negative observation, at this juncture, we believe this was merely from minor profit taking activity following the prior session’s sharp upward move. Towards the downside, provided the MYR2,400 support level is not breached, the rebound that started from early May would still be considered as intact. Maintain our positive trading bias.

We recommended traders to stay in long positions. We initiated these at MYR2,472 – closing level of 19 Jun. To manage risks, a stop-loss can be placed below MYR2,400.

The immediate support is pegged at MYR2,435 – price point of 19 Jun. This is followed by MYR2,400. Conversely, the immediate resistance is set to emerge at MYR2,500, followed by MYR2,550.

Source: RHB Securities Research - 23 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024