FKLI- 1,500-pt Still Holding Up

rhboskres

Publish date: Wed, 24 Jun 2020, 12:55 PM

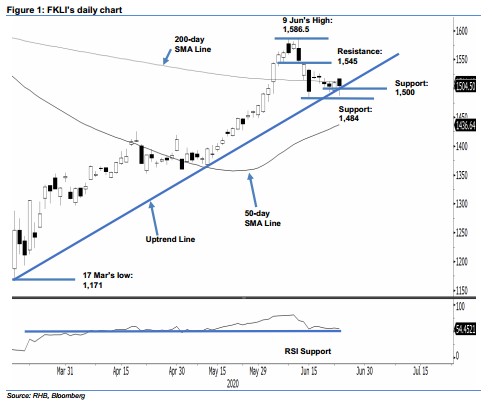

Maintain short positions until a reversal signal appears. The FKLI’s 1,500-pt support mark and multi-week uptrend line were briefly tested yesterday. The index hit a low and high of 1,487 pts and 1,517 pts, before closing 5.5 pts lower at 1,504.5 pts. The ability of the support levels to prevail at the close suggests that the bulls are still trying to engineer a rebound, following the recent sharp retracement. Based on the daily chart, an upside breach of the 1,515-pt level will trigger a signal that a deeper rebound is about to kick in. Pending this, we are maintaining a negative trading bias.

We advise traders to stay in short positions. We initiated these at 1,548.5 pts – the closing level of 11 Jun. To manage risks, a stop-loss can now be set above 1,515 pts.

We are keeping the immediate support at the 1,500-pt mark. This is followed by 1,484 pts, the low of 15 Jun. Moving up, the immediate resistance is at 1,515-pts (slightly above the 200-day SMA line). This is followed by 1,545 pts, derived from 12 Jun’s candle.

Source: RHB Securities Research - 24 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024