COMEX Gold - Testing the Multi-Year High

rhboskres

Publish date: Thu, 25 Jun 2020, 07:34 PM

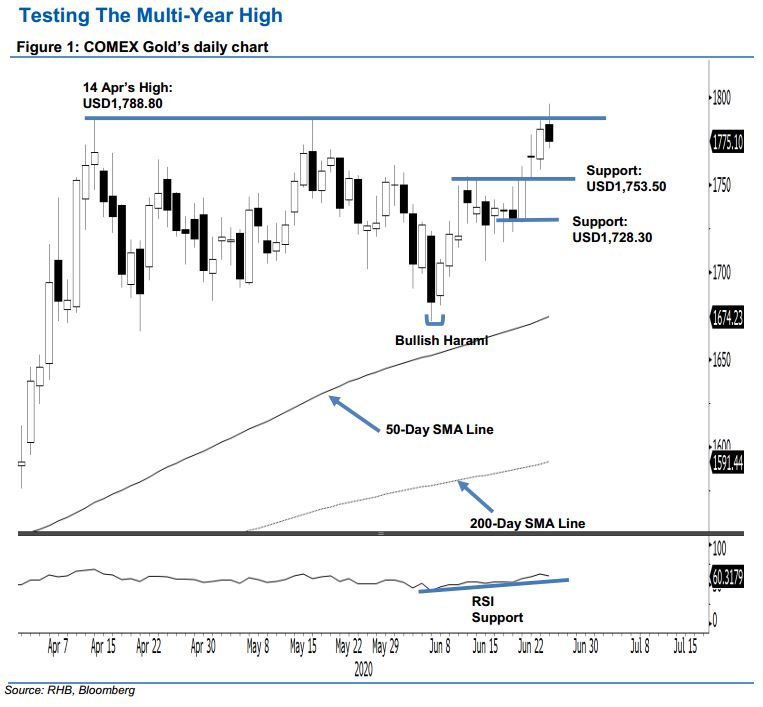

Maintain long positions as the technical picture stays positive. The COMEX Gold experienced a negative intraday price reversal. At one point, it hit a high of USD1,796.10 to test the USD1,788.80 immediate resistance before reversing to close USD6.90 lower at USD1,775.10. We do not see the negative price reaction around the said immediate resistance as an indication that the bulls have run out of steam – instead it is more likely profittaking activity. Broadly, we believe the commodity has completed its multi-week sideways correction phase, and it is now likely in the process of extending its multi-year uptrend. Maintain our positive trading bias.

We recommend traders to stay in long positions. We initiated these at USD1,766.40 – the closing level of 22 Jun. For risk-management purposes, a stop-loss can now be placed below the USD1,728.30 mark.

The immediate support is maintained at USD1,753.50, which was derived from 22 Jun’s low. This is followed by USD1,728.30, or the low of 19 Jun. Conversely, the immediate resistance is set at USD1,788.80, ie 14 Apr’s high, followed by the USD1,800 round figure.

Source: RHB Securities Research - 25 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024