FKLI & FCPO - 26 June 2020

rhboskres

Publish date: Fri, 26 Jun 2020, 04:37 PM

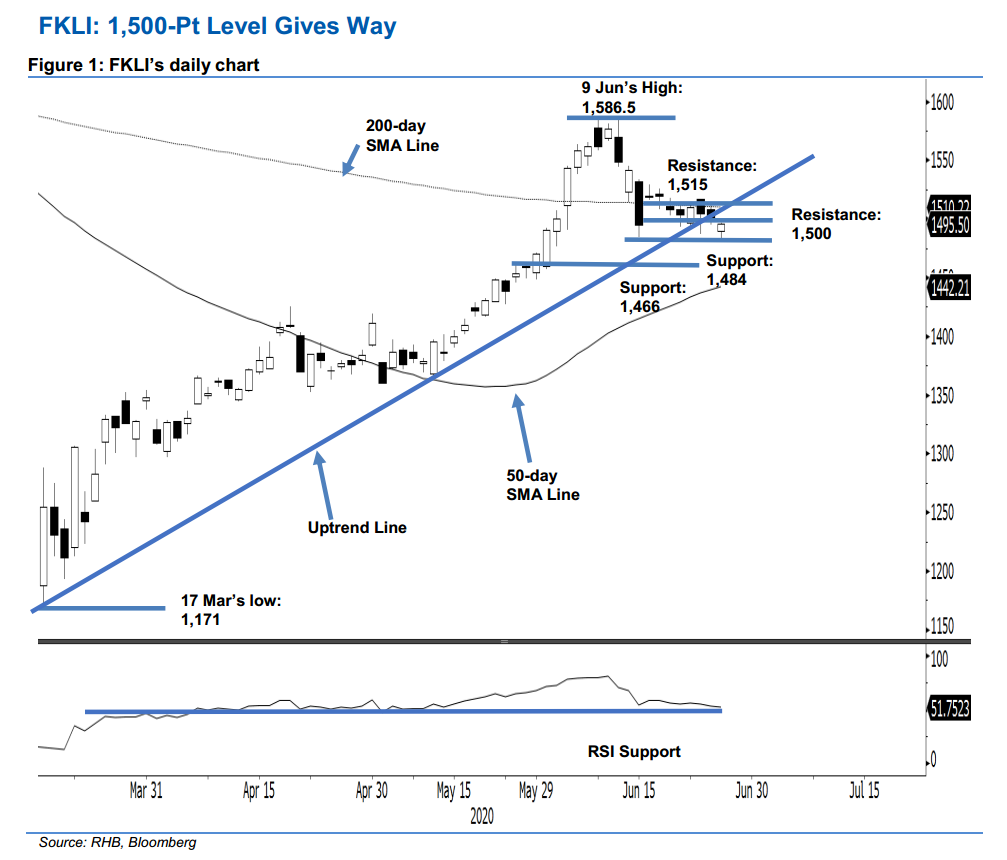

Tag the correction phase; maintain short positions. After managing to keep the FKLI above the 1,500-pt level over the past few sessions, the bulls finally bowed to selling pressure. The index settled marginally below the said level at 1,495.5 pts – a decline of 3.5 pts. The closing level also placed the index slightly below the multi-week uptrend line. While the breakdown is not decisive, it still can be seen as a negative price signal, reinforcing our negative trading bias. All in, we believe the index is still in the process of developing, at the minimum, a multi-week correction phase. Maintain our negative trading bias.

We advise traders to stay in short positions. We initiated these at 1,548.5 pts – the closing level of 11 Jun. To manage risks, a stop-loss can now be set above 1,515 pts.

The immediate support is revised to 1,484 pts, the low of 15 Jun. This is followed by 1,466 pts – the high of 29 May. Meanwhile, the immediate resistance is now eyed at 1,500-pt mark. This is followed by 1,515-pts (slightly above the 200-day SMA line).

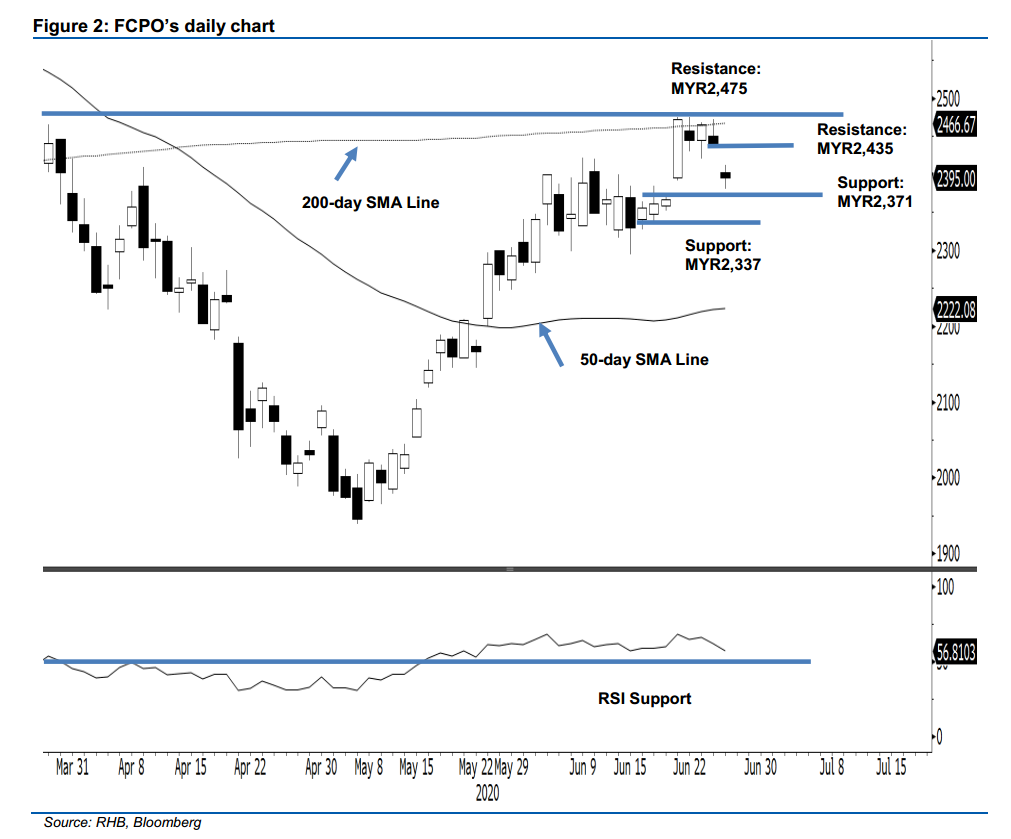

Rejected from 200-day SMA line; initiate short positions. The FCPO formed a “Downside Gap” to end MYR41 lower at MYR2,395, off the low of MYR2,381. The closing level places the commodity back below the 200-day SMA line, also breaching the MYR2,400 support. The commodity had been attempting to decisively cross the 200-day SMA line over the past few sessions. However, the latest weak performance likely suggests a potential price rejection from the said level. Premised on this, we switch our trading bias to negative.

Our previous long positions, initiated at MYR2,472 – the closing level of 19 Jun – were closed out at MYR2,400 in the latest session. With a bias signalling the appearance of a price rejection, we initiate short positions at the latest closing level. To manage risks, a stop-loss can be placed above MYR2,475.

The immediate support is revised to MYR2,371, the high of 11 Jun. This is followed by MYR2,337 – derived from the low of 17 Jun. Meanwhile, the immediate resistance is now eyed at MYR2,435, the low of 24 Jun, followed by MYR2,475 – the high of 19 Jun.

Source: RHB Securities Research - 26 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024