WTI Crude- Still Eying Correction Extension

rhboskres

Publish date: Tue, 30 Jun 2020, 10:17 AM

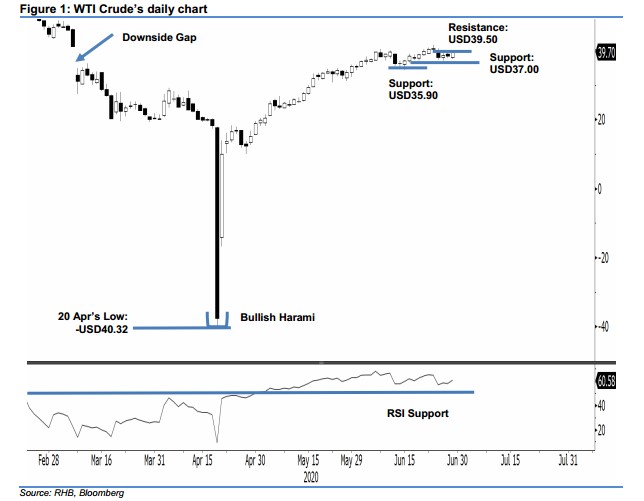

Maintain short positions as the immediate resistance was not decisively crossed. The WTI Crude staged a positive intraday price reversal, rebounding from a low of USD37.50 to settle at USD39.70 – indicating a USD1.21 gain. The closing level also placed the commodity slightly above the immediate resistance of USD39.50. Despite the positive performance, chances are high that the commodity is still in the process of developing a correction, following the previous multi-week sharp rebound. Hence, we are keeping our negative trading bias.

As the commodity was not able to firmly close above the said immediate resistance, we keep our recommendation for traders to stay in short positions. We initiated these at USD38.01 – the closing level of 24 Jun. To manage risk, a stop-loss can be placed above USD39.50.

The immediate support is eyed at USD37.00, near the low of 18 Jun. This is followed by USD35.90 – the price point of 12 Jun. Conversely, the immediate resistance is pegged at USD39.50 – as it was not firmly breached by the bulls during the latest session. This is followed by USD41.63, or the high of 23 Jun.

Source: RHB Securities Research - 30 Jun 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024