FKLI- Back Into The Resistance Zone

rhboskres

Publish date: Wed, 01 Jul 2020, 05:44 PM

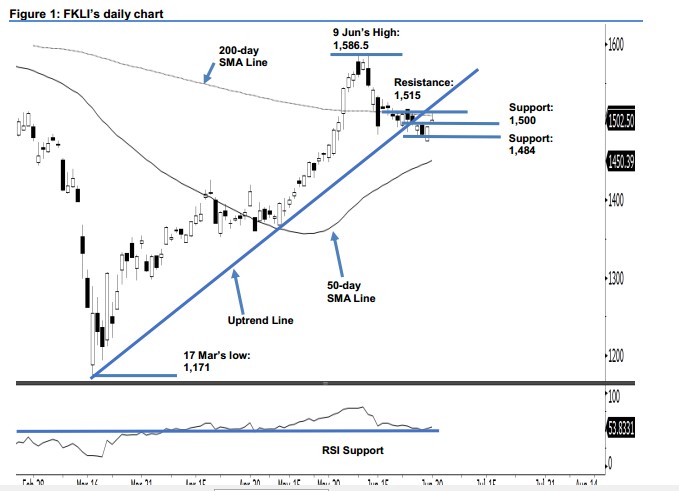

Bulls have more to prove; maintain short positions. The FKLI closed 8 pts higher, at 1,502.5 pts yesterday. The index also briefly tested the 200-day SMA line with a high of 1,512.5 pts. The closing level again put the index back in the critical support-turned-resistance zone of 1,500-1,515 pts. However, as long as the index is still capped by this resistance, the correction phase that started from the high of 1,586.5 pts on 9 Jun should remain intact. We maintain our negative trading bias.

We advise traders to stay in short positions. We initiated these at 1,548.5 pts, the closing level of 11 Jun. To manage risks, a stop-loss can now be set above 1,515 pts.

We revised the immediate support to the 1,500-pt mark. This is followed by 1,484 pts, the low of 15 Jun. Meanwhile, the immediate resistance is now at 1,515 pts (slightly above the 200-day SMA line), followed by 1,534 pts, the high of 15 Jun

Source: RHB Securities Research - 1 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024