Hang Seng Index Futures- Revisiting 50-Day SMA

rhboskres

Publish date: Wed, 01 Jul 2020, 05:49 PM

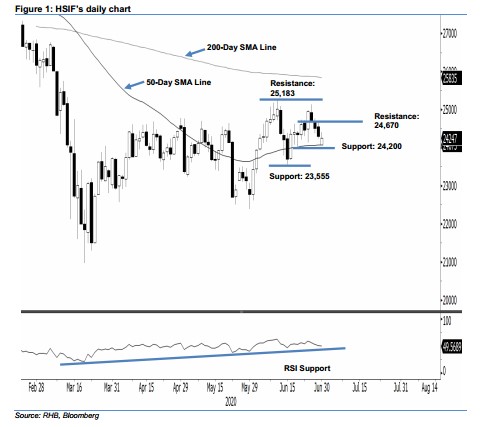

Maintain short positions. The HSIF ended the latest session positively to close at 24,247 pts. This was after it briefly tested the 50-day SMA line during the session. Despite the positive price reaction from the said SMA line, we believe further positive price actions are needed in the coming sessions to invalidate our current negative trading bias on the index. A downside breach of the SMA line could open up room for further weakness for the index.

We advise traders to stay in short positions. We initiated these at 24,212 pts, which was the closing level of 12 Jun. For risk-management purposes, a stop-loss can now be placed at above the 25,183-pt threshold.

We revised the immediate support to 24,000 pts – a round figure near the 50-day SMA line. This is followed by 23,555 pts – the low of 5 Jun. Meanwhile, the immediate resistance is pegged at 24,670 pts – the high of 29 Jun – followed by 25,183 pts, which was the high of 9 Jun

Source: RHB Securities Research - 1 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024