FCPO- No Confirmation For a Reversal Yet

rhboskres

Publish date: Thu, 02 Jul 2020, 05:36 PM

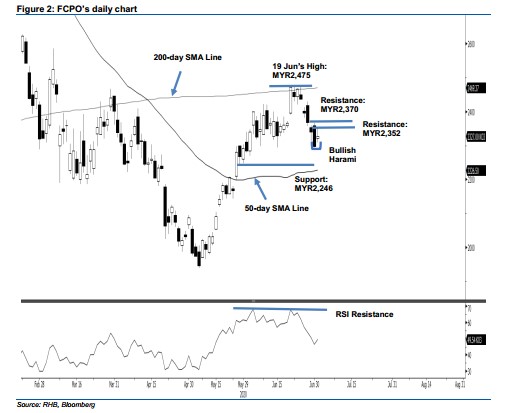

Maintain short positions. The FCPO gave back a good part of its intraday gains to settle MYR30 higher at MYR2,327 – the high was posted at MYR2,352. Consequently, a “Bullish Harami” formation appeared, indicating the potential for a reversal. However, to confirm this possibility, further positive price actions need to take place in the coming sessions. Until this happens, we continue to hold the view that the commodity’s retracement phase is firmly in place. Premised on this, we are keeping our negative trading bias.

As the bulls have yet to show signs of regaining control, we recommend that traders stay in short positions. We initiated these at MYR2,395, the closing level of 25 Jun. To manage risks, a stop-loss can be placed at the breakeven mark.

The immediate support maintained at MYR2,294, the low of 15 Jun. This is followed by MYR2,246 – derived from the low of 28 May. On the other hand, the overhead resistance is pegged MYR2,352 – the latest high. This is followed by MYR2,370 – slightly above 30 Jun’s high

Source: RHB Securities Research - 2 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024