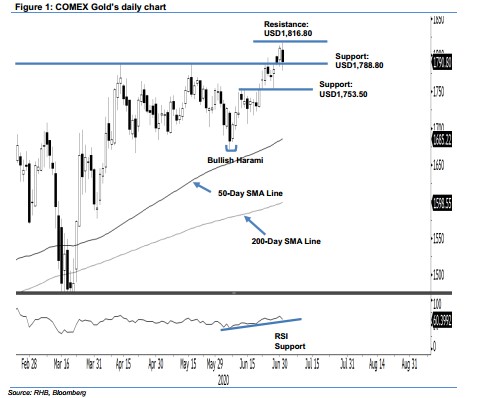

COMEX Gold- No Trend Reversal Signal Yet

rhboskres

Publish date: Thu, 02 Jul 2020, 05:37 PM

Maintain long positions. The COMEX Gold experienced a negative intraday price reversal. After hitting a high of USD1,816.80, the commodity retraced to close USD19.20 weaker at USD1,790.80 – slightly above the previous resistance-turned-support level of USD1,788.80. Based on the daily chart, we believe the latest negative price action merely suggests the possibility of profit-taking activity. The uptrend is still firmly in place, more so as the said immediate support is still holding up. We maintain our positive trading bias.

We recommend that traders stay in long positions. We initiated these at USD1,766.40 – the closing level of 22 Jun. For risk-management purposes, a stop-loss can now be placed at the breakeven mark.

Immediate support is revised to USD1,788.80 – the high of 14 Apr. This is followed by USD1,753.50, which was 22 Jun’s low. Moving up, the immediate resistance is now eyed at the USD1,800 round figure, followed by USD1,816.80, which is the latest high

Source: RHB Securities Research - 2 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024