WTI Crude- Initiate Long Positions With Tight Stop-Loss

rhboskres

Publish date: Thu, 02 Jul 2020, 05:39 PM

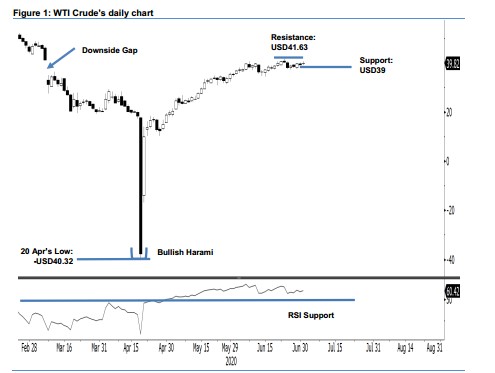

Initiate short positons as the immediate resistance is cracked. The WTI Crude ceased the latest session USD0.55 stronger at USD39.82, after oscillating between a low and high of USD39.05 and USD40.58. The closing level placed the black gold above the previous immediate resistance of USD39.50 – indicating that the bulls may still be in control of the rebound. Based on this, there could still be a possibility of the commodity retesting its recent high of USD41.63. Hence, we switch our trading bias to positive.

Our previous long positions initiated at USD38.01 – the closing level of 24 Jun – were closed out at USD39.50 during the latest session. On the bias that the rebound may still carry on, we initiate long positions at the latest closing level. To manage risk, a stop-loss can be placed below USD39.00

The immediate support is now pegged at USD39.00, which is near the latest low. This is followed by USD37.00, close to the low of 18 Jun. Conversely, the immediate resistance is now set at USD41.63 – or the high of 23 Jun – followed by USD43.32, or the low of 2 Mar.

Source: RHB Securities Research - 2 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024