FKLI- Crossing The Resistance Zone

rhboskres

Publish date: Thu, 02 Jul 2020, 06:55 PM

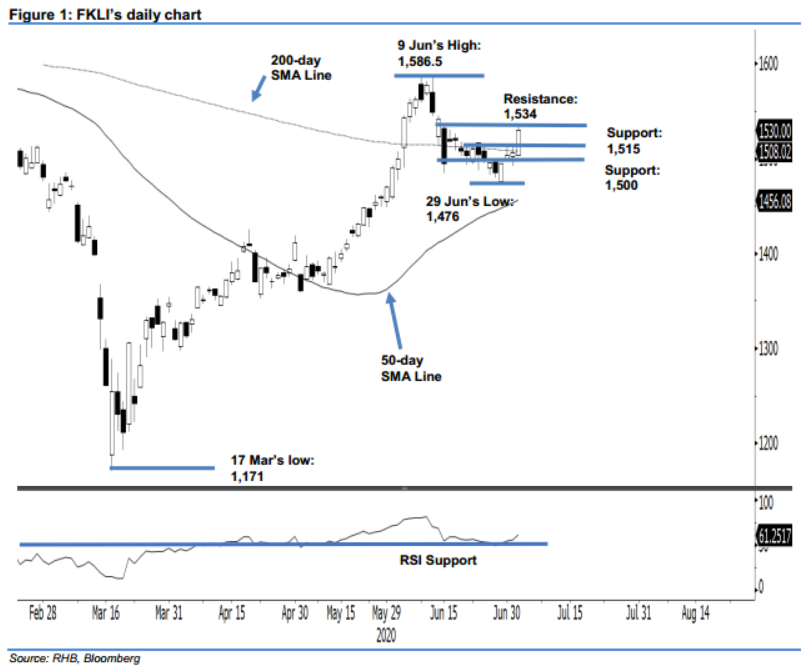

Initiate long positions, as the bulls are signalling a return. The FKLI decisively crossed above the previous resistance zone of 1,500-1,515 pts and the 200-day SMA line yesterday, climbing 24 pts to close at 1,530 pts. The positive price signals indicate that the index’s retracement phase has likely reached an interim low, if not completed – registering a low of 1,476 pts on 29 Jun. This indicates that the FKLI, at the minimum, is developing a rebound. Premised on this, we switch our trading bias to positive.

Our previous short positions – initiated at 1,548.5 pts, the closing level of 11 Jun – were closed out at 1,515 pts in the latest session. Concurrently, we open long positions at the latest closing. To manage risks, a stop-loss can now be set below the 1,500-pt mark

The immediate support is revised to 1,515 pts, followed by 1,500 pts – the previous multi-year support. On the other hand, the immediate resistance is now at 1,534 pts, the high of 15 Jun. This is followed by 1,545 pts – the high of 12 Jun

Source: RHB Securities Research - 2 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024