FCPO- Retracement Still Extending

rhboskres

Publish date: Mon, 06 Jul 2020, 05:46 PM

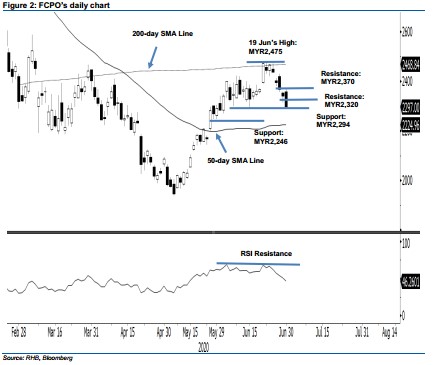

Maintain short positions. The FCPO closed MYR44.00 weaker at MYR2,297 yesterday, breaching below the previous immediate support of MYR2,313. Trading ranged between MYR2,293 and MYR2,367. The weak performance continues to reinforce our bias that the commodity is likely correcting the upward move that occurred between early May and 19 Jun. Towards the downside, should the MYR2,294 level be breached, chances are high for the commodity to re-test the 50-day SMA line. Premised on this, we are making no change to our negative trading bias.

Without a price reversal signal to mark a possible end of the retracement phase, we recommend that traders stay in short positions. We initiated these at MYR2,395, the closing level of 25 Jun. To manage risks, a stop-loss can be placed at the breakeven mark.

The immediate support is revised to MYR2,294, the low of 15 Jun. This is followed by MYR2,246 – derived from the low of 28 May. Conversely, the overhead resistance is at MYR2,320, the price point of the latest session, followed by MYR2,370 – slightly above its latest high

Source: RHB Securities Research - 6 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024