WTI Crude: Still Crawling Up

rhboskres

Publish date: Tue, 07 Jul 2020, 10:51 AM

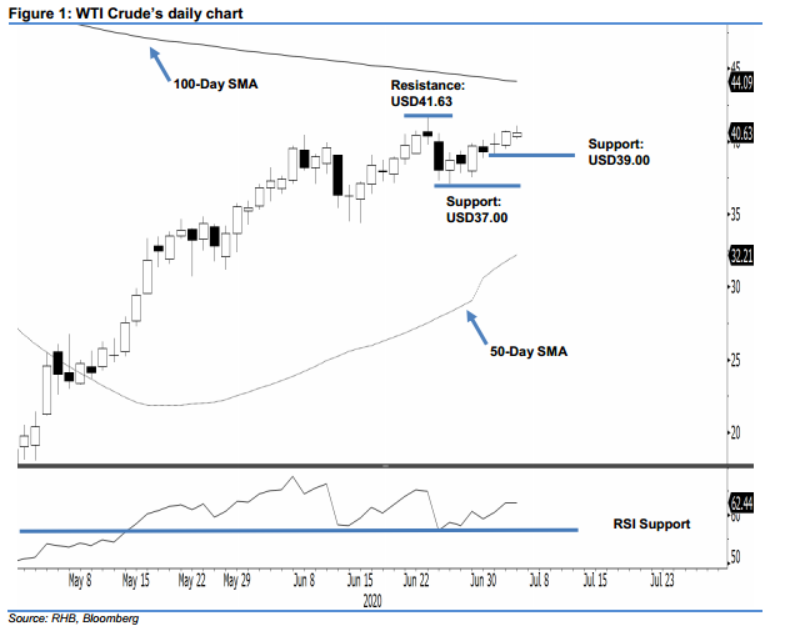

No price exhaustion yet. The WTI Crude ended the latest trade mildly lower – by USD0.02 – to USD40.63. This was after it ranged between USD40.15 and USD41.08. While the commodity’s recent sessions’ rebounds are showing signs of lacking of momentum, in the absence of price reversal signals, the WTI Crude’s rebound – from the recent low of around USD37.00 – is still considered intact. Furthermore, the RSI reading remains below the overbought reading. Premised on this, we keep to our positive trading bias.

We maintain our recommendation for traders to stay in long positions. We initiated these at USD39.82, which was the closing level of 1 Jul. To manage the risk, a stop-loss can be placed below the USD39.00 level.

We are keeping the immediate support at USD39.00 – this is near 1 Jul’s low. This is followed by USD37.00, which was close to the 18 Jun low. Moving up, the immediate resistance is eyed at USD41.63 – the high of 23 Jun – and followed by USD43.32, or the low of 2 Mar.

Source: RHB Securities Research - 7 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024