FKLI: Bulls Are Charging Ahead

rhboskres

Publish date: Tue, 07 Jul 2020, 11:00 AM

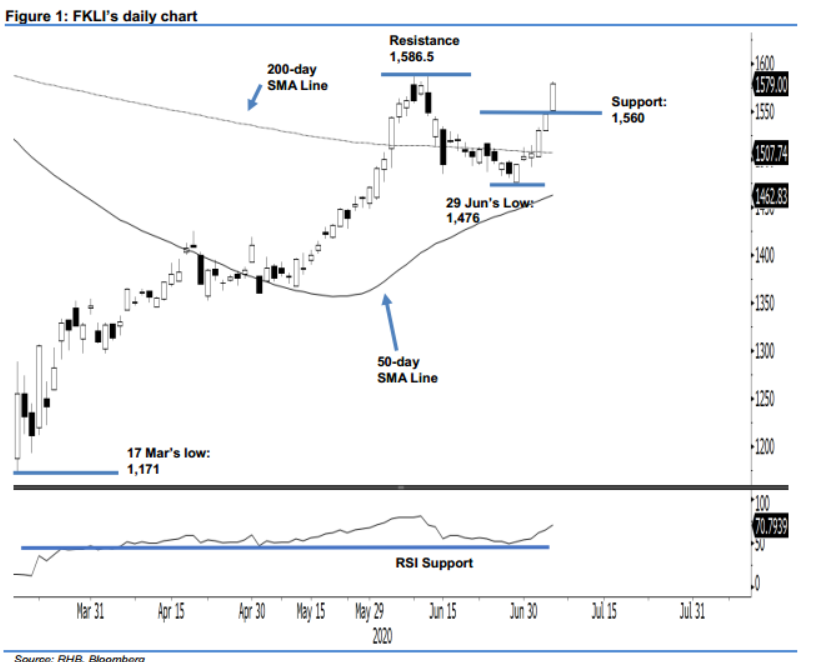

Maintain long positions, while tightening risk management further. The FKLI continued to sustain it recent sessions’ positive price momentum, adding 31 pts to close at 1,579 pts in the latest session – this resulted in the index coming in near to test its 9 Jun high of 1,586.5 pts. While the RSI reading is revisiting the overbought mark, price actions suggest the rebound is still firmly in place without showing signs of exhaustion. Hence, we are keeping our positive trading bias.

On the observation that the rebound is still showing signs of extending, we advise traders to stay in long positions. We initiated these at 1,530 pts – the closing level of 2 Jun. To manage risks, a stop-loss can now be set below 1,550 pts.

The immediate support is revised to 1,560 pts – price point of the latest session, followed by 1,550 pts – near the latest low. Conversely, the immediate resistance is now eyed at 1,586.5 pts – 9 Jun’s high. This is followed by 1,600 pts.

Source: RHB Securities Research - 7 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024