FCPO: Deeper Rebound May Be Developing

rhboskres

Publish date: Tue, 07 Jul 2020, 11:01 AM

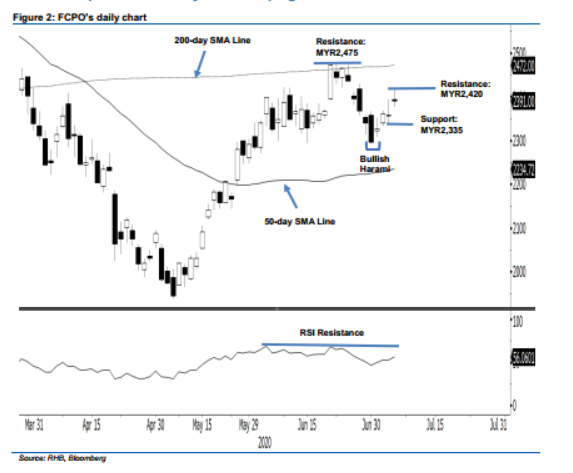

Initiate long positions. The FCPO ended the latest session on a strong footing, adding MYR33 to close at MYR2,391 – it reached a high of MYR2,420. The closing level placed the commodity above the previous immediate resistance of MRY2,370. In our view this signals a stronger rebound may be taking place. The commodity has been developing this rebound following 1 Jul’s “Bullish Harami” formation. Hence, we switch our trading bias from negative to positive.

Our previous short positions initiated at MYR2,395, the closing level of 25 Jun, were closed out at MYR2,370 in the latest session. On the bias that a deeper rebound may be taking place, we initiate long positions at the latest closing. To manage risk, a stop-loss can be pegged at below MYR2,377.

We revise the immediate support to MYR2,377 – the latest low. This is followed by MYR2,335 – the low of 3 Jul. On the other hand, the immediate resistance is now pegged at MYR2,420, which is the latest high, followed by MYR2,475 – the high of 19 Jun.

Source: RHB Securities Research - 13 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024