FCPO: Rebound Fails To Sustain

rhboskres

Publish date: Wed, 08 Jul 2020, 10:24 PM

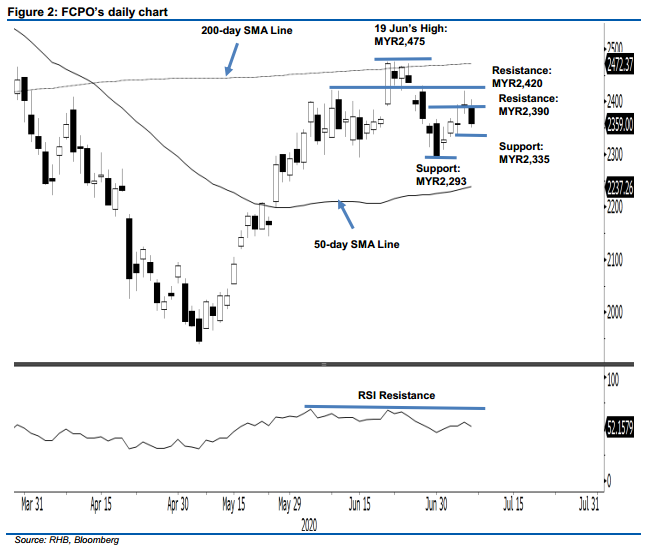

Initiate long positions – possible “Head and Shoulder” formation. The FCPO settled the latest trade lower by MYR32 at MYR2,359. This suggests it failed to sustain its recent sessions’ rebound and has invalidated our previous positive trading bias. Looking at the commodity’s price pattern, there is a possibility that a “Head and Shoulder” formation has appeared, with the 6 Jul’s high of MYR2,420 being the likely right shoulder of the formation. Chances are strong that the retracement, which started from the high of MYR2,475, has resumed. Hence, we now switch our trading bias to negative from positive.

Our previous long positions initiated at MYR2,391 on 6 Jul were closed out at MYR2,377 in the latest session. Concurrently, we initiate short positions at the latest closing. To manage risk, a stop-loss can be pegged at above MYR2,420.

We revise the immediate support to MYR2,335 – the low of 3 Jul. This is followed by MYR2,293 – the low of 30 Jun. Moving up, the immediate resistance is now pegged at MYR2,390 – derived from the latest candle. This is followed by MYR2,420, which is 6 Jul’s high

Source: RHB Securities Research - 13 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024