Hang Seng Index Futures: Tightening Up the Risk Management

rhboskres

Publish date: Wed, 08 Jul 2020, 10:28 PM

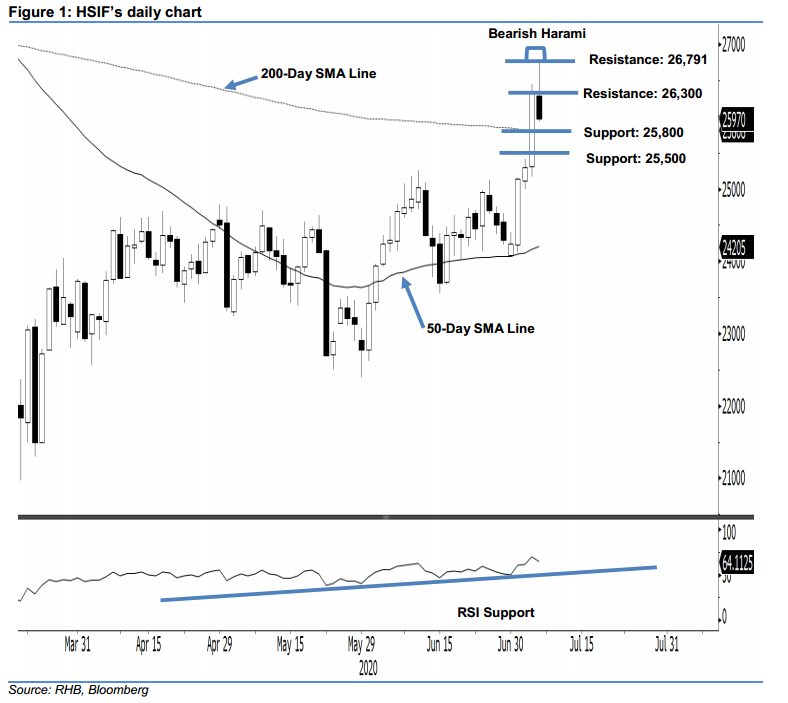

Maintain long positions. The HSIF’s latest session’s intraday tone was negative, seeing the index sliding from a 26,791-pt high – posted earlier in the session – to settle at 25,970 pts. This indicated a 361-pt decline. Consequently, a “Bearish Harami” formation appeared. Despite the weak performance, the HSIF is still holding above the 200-day SMA line – indicating that the overall trend is still positive. A giveaway of this SMA line could signal the higher risk of a deeper correction. Pending this, we maintain our positive trading bias.

We continue to recommend traders stay in long positions. We initiated these at 25,295 pts, which was 3 Jul’s closing level. For risk-management purposes, a stop-loss can now be placed at the breakeven mark.

We revise the immediate support to 25,800 pts, which is near the 200-day SMA line. This is followed by the 25,500- pt mark. Conversely, the resistance level is now pegged at 26,300 pts, and followed by the 26,791-pt threshold.

Source: RHB Securities Research - 8 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024