FKLI - No Negative Follow Through

rhboskres

Publish date: Thu, 09 Jul 2020, 06:17 PM

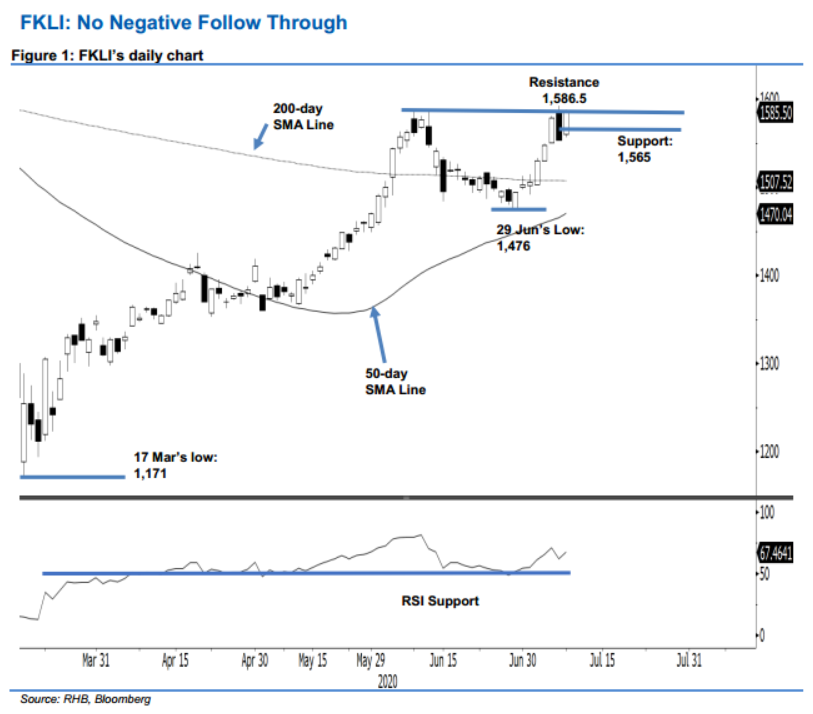

Maintain long positions while moving trailing-stop further. The FKLI showed no negative price follow-through from the prior session’s negative intraday price reversal, which took place after it briefly tested the 1,586.5-pt resistance – this suggests that the risk for a deeper correction to set in is still contained. The index settled 32 pts stronger at 1,585.5 pts – marginally below the said resistance. Based on the latest technical picture, we now believe that provided the 1,565-pt immediate support is not breached, the index’s rebound may continue to extend. Hence, we are keeping our positive trading bias.

We advise traders to stay in long positions. We initiated these at 1,530 pts – the closing level of 2 Jun. To manage risks, a stop-loss can now be set below 1,565 pts.

The immediate support is revised to 1,565 pts – price point of the latest session, followed by 1,550 pts – near 6 Jul’s low. Moving up, the immediate resistance now pegged at 1,586.5 pts – 9 Jun’s high. This is followed by 1,600 pts.

Source: RHB Securities Research - 9 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024