FCPO - Downside Risk Remains Hig

rhboskres

Publish date: Fri, 10 Jul 2020, 06:47 PM

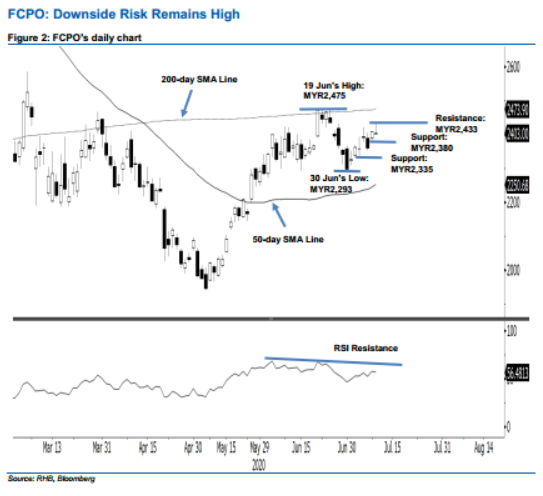

Maintain short positions. The FCPO failed to hold on to its earlier session’s positive performance, ending MYR4 weaker at MYR2,403 after reaching a high of MYR2,433. The negative intraday performance suggests the bears are still in control over the commodity’s price trend. More importantly, we believe the soft commodity’s price correction phase, which started from the high of MYR2,475 on 10 Jun, is still incomplete. Towards the downside, our target is for the commodity to retest 30 Jun’s low of MYR2,293. Maintain our negative trading bias.

We advise traders to stay in short positions. We initiated these at MYR2,359 – the closing level of 7 Jul. To manage risk, a stop-loss can be placed at above MYR2,450.

The immediate support is maintained at MYR2,380 – near 8 Jul’s low. This is followed by MYR2,335 – the low of 3 Jul. Menawhile, the immediate resistance is now eyed at MYR2,433 – the latest high. This is followed by MYR2,450 – price point of 24 Jun.

Source: RHB Securities Research - 10 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024