WTI Crude- Triggering Short Signal

rhboskres

Publish date: Tue, 14 Jul 2020, 09:50 AM

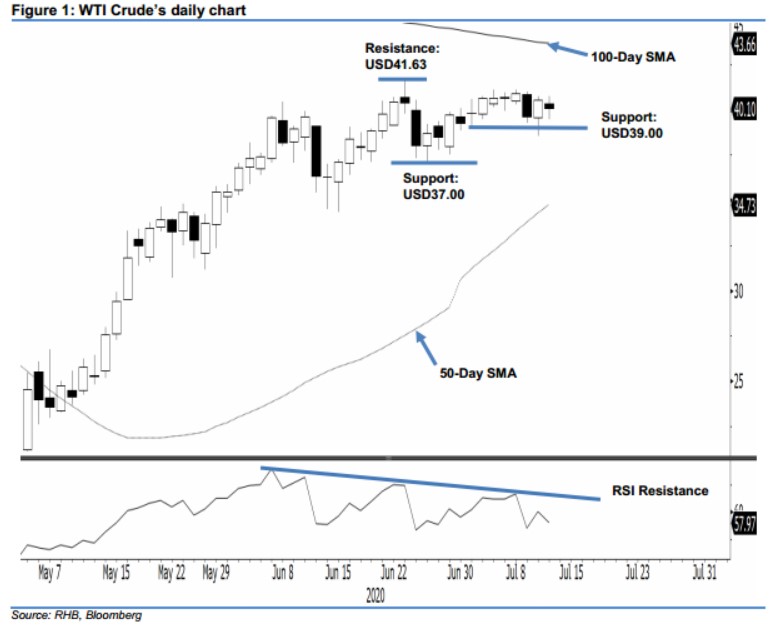

Risk for correction is high; initiate short positions. The WTI Crude ceased the latest session USD0.45 lower at USD40.10 – after hitting a high of USD40.72. We believe chances are high that the black gold is in the process of developing a correction phase, following the multi-week sharp rebound from the low in April which reached a high of USD41.63 on 23 Jun. This negative bias is further supported by the RSI reading which continues to trend lower – indicating the commodity’s recent rebound momentum is fading. Switch our trading bias from positive to negative.

Our previous long positions initiated at USD39.82, the closing level of 1 Jul, were closed out at breakeven on 9 Jul. Concurrently, we initiate short positions at USD39.62 – the closing level of 9 Jul. To manage risks, a stop-loss can be placed at above USD41.63.

The immediate support is maintained at USD39.00, near 1 Jul’s low. This is followed by USD37.00, which is close to the low of 18 Jun. Moving up, the immediate resistance is now pegged at USD41.08 – the high of 8 Jul, followed by USD41.63 – the high of 23 Jun

Source: RHB Securities Research - 14 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024