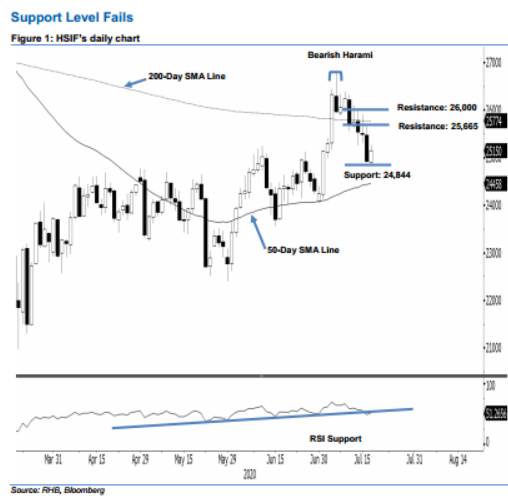

Hang Seng Index Futures - Support Level Fails

rhboskres

Publish date: Mon, 20 Jul 2020, 07:04 PM

Initiate short positions as rebound failed to hold. The HSIF staged a minor rebound following the prior session’s relatively sharp decline. At close, the index advanced 230 pts to close at 25,150 pts – off the high of 25,257 pts. However, this positive performance was insufficient to signal that the retracement, which began with 7 Jul’s “Bearish Harami” formation, has reached an end. This negative bias is also supported by the fact that the index is now once again trading below the 200-day SMA line.

Our previous long positions initiated at 25,295 pts, which was 3 Jul’s closing level, were closed out on the downside breach of 25,500-pts on 16 Jul. Concurrently, we initiated long positions at 24,920 pts. For risk-management purposes, a stop-loss can be placed above 25,665 pts.

Immediate support is revised to 24,844 pts, which is the low of 17 Jul. This is followed by 24,500 pts. Conversely, the immediate resistance is eyed at 25,665 pts, the high of 17 Jul. This is followed by the 26,000-pt round figure.

Source: RHB Securities Research - 20 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024