WTI Crude - Still Capped by Immediate Resistance

rhboskres

Publish date: Tue, 21 Jul 2020, 06:57 PM

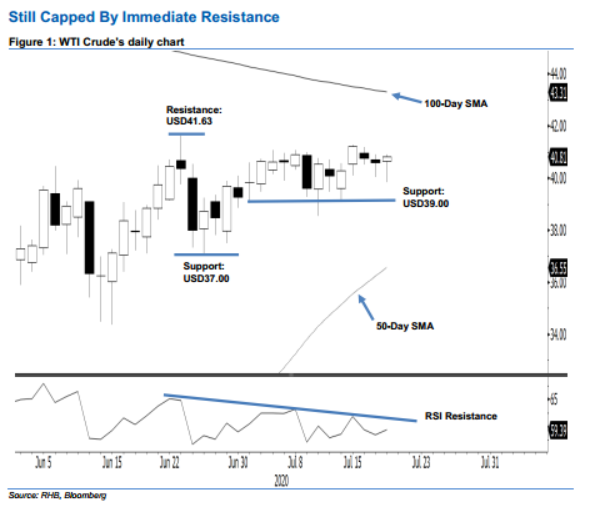

Maintain short positions. The WTI Crude staged a positive intraday price reversal to end the session USD0.22 higher at USD40.81. Its low was at USD39.83. While the black gold has been able to hold above the USD39.00 immediate support over the past week, towards the upside, it is still struggling to show signs of extending its rebound. Broadly, we still see that the commodity has reached an interim high of USD41.63 posted on 23 Jun, and that it is now in the process of developing a correction phase. We maintain our negative trading bias.

We keep our recommendation for traders to stay in short positions, which we initiated at USD39.62 – the closing level of 9 Jul. To manage risks, a stop-loss can be placed above USD41.63.

We maintain the immediate support at USD39.00, near 1 Jul’s low. This is followed by USD37.00, which is close to the low of 18 Jun. Moving up, the immediate resistance is set at USD41.63, or the high of 23 Jun. This is followed by USD43.50, which is near the 100-day SMA line.

Source: RHB Securities Research - 21 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024