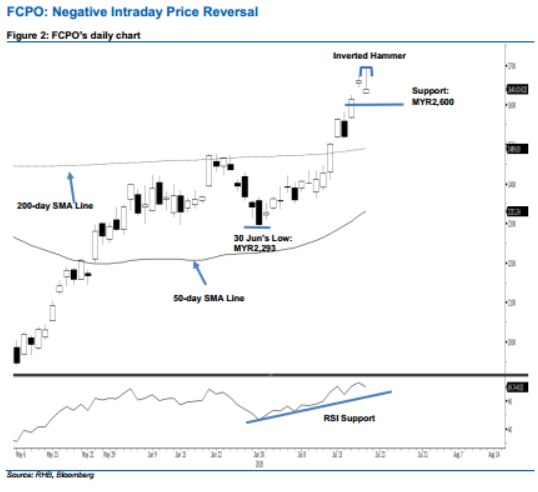

FCPO - Negative Intraday Price Reversal

rhboskres

Publish date: Wed, 22 Jul 2020, 06:56 PM

Moving up trailing-stop; maintain long positions. The FCPO underwent a sharp negative price reversal after hitting a high of MYR2,692 – not too far away from the MYR2,700 resistance point – before closing MYR21.00 lower at MYR2,640. Consequently an “Inverted Hammer” formation appeared. This can be regarded as a possible price exhaustion signal following the recent price surge. However, to confirm the possibility of a deeper retracement developing, the latest low of MYR2,627 has to be breached in the coming sessions. Until this happens, we are maintaining a positive trading bias.

We advise traders to stay in long positions. We initiated these at MYR2,502, the closing level of 14 Jul. To manage risks, a stop-loss can now be placed below MYR2,627

We revise the immediate support to MYR2,627, the latest low. This is followed by MYR2,600. Moving up, the immediate resistance is maintained at MYR2,666, derived from 17 Feb’s high. This is followed by MYR2,700.

Source: RHB Securities Research - 22 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024