WTI Crude - Rebound Carries on

rhboskres

Publish date: Thu, 23 Jul 2020, 06:09 PM

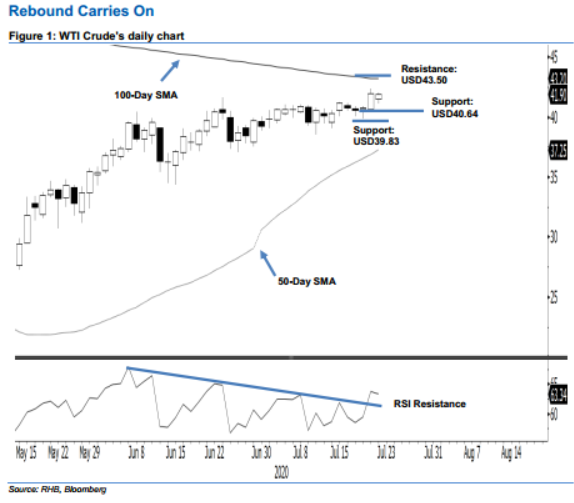

Bulls are reluctant to let go; Initiate long positions. The WTI Crude ended the latest session slightly lower – by USD0.06 to USD41.90 – off its high of USD42.03. This comes after the commodity crossed above the previous USD41.63 immediate resistance during the earlier session. This signals that the multi-month rebound is still in place, and nullifies our previous bias for it to stage a correction phase. Additionally, the RSI has breached above the resistance line, indicating that momentum is improving. Hence, we switch our trading bias from negative to positive.

Our previous short positions initiated at USD39.62 – the closing level of 9 Jul – were closed out at USD41.63 on 21 Jul. Concurrently, we initiated long positions at USD41.96. To manage risks, a stop-loss can be placed below USD39.83.

We now expect the immediate support to emerge at USD40.64 – the low of 21 Jul. This is followed by USD39.83, or the low of 20 Jul. Conversely, the resistance points are now eyed at USD43.50, which is near the 100-day SMA line, followed by USD45.00.

Source: RHB Securities Research - 23 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024