WTI Crude - in Crawling Up Mode

rhboskres

Publish date: Tue, 28 Jul 2020, 09:04 PM

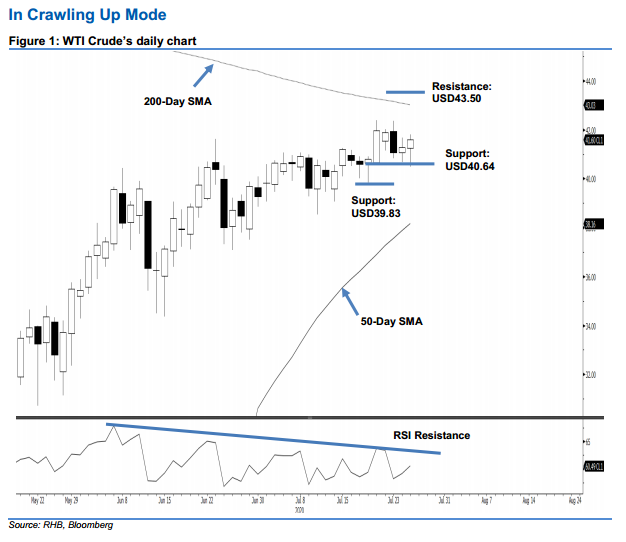

No price exhaustion signal; maintain long positions. The WTI Crude rebounded to end the latest session USD0.31 higher at USD41.60 – this was after it briefly tested the USD40.64 immediate support. While we note that the commodity’s upward move is showing signs of a weakening in momentum, with the RSI again falling below the resistance line, there was no price signal that would suggest its upward move is due for a correction. Hence, we are keeping our positive trading bias.

In the absence of a price exhaustion signal, we advise traders to stay in long positions, which we initiated at USD41.96 – the closing level of 21 Jul. To manage risks, a stop-loss can be placed below USD39.83.

We are keeping the immediate support at USD40.64 – the low of 21 Jul. This is followed by USD39.83, or the low of 20 Jul. Moving up, the immediate resistance is set at USD43.50, followed by USD45.00.

Source: RHB Securities Research - 28 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024