FCPO - Likely A Counter - Trend Rebound

rhboskres

Publish date: Thu, 30 Jul 2020, 06:45 PM

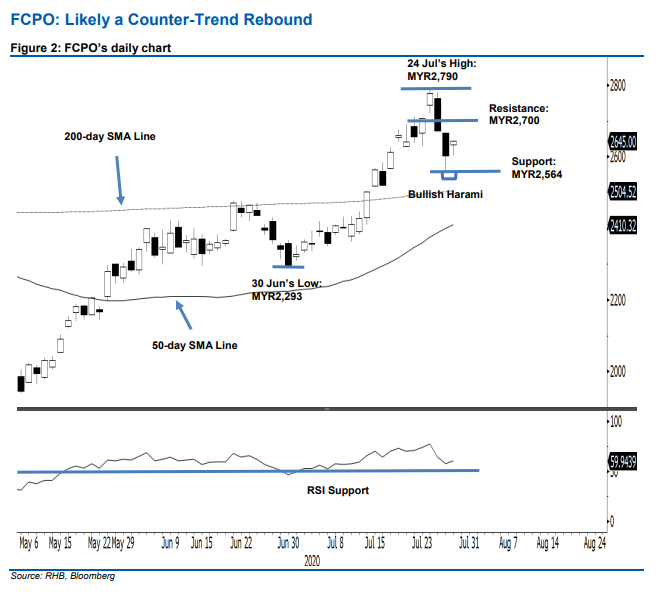

Maintain short positions. The FCPO ended the latest session on a strong note, adding MYR42 to close at MYR2,645 and crossing above MYR2,627, the previous immediate resistance. Conseequently, a “Bullish Harami” formation appeared. The positive session was within our expectations given the commodity’s prior two sessions’ sharp retracement. This positive performance is likely just a counter-trend rebound and once this is completed, we are expecting the retracement phase to extend. This retracement phase is meant to correct the prior upward move that took place between early-May and 24 Jul. Maintain our negative trading bias.

We advise traders to stay in short positions. We initiated these at MYR2,672 – the closing level of 27 Jul. To manage risks, a stop-loss can now be set above MYR2,790.

The immediate support is now set MYR2,600 round figure – also near the latest low. This is followed by MYR2,564, the low of 17 Jul. Towards the upside, the immediate resistance is eyed at MYR2,650, the price point of 28 Jul. This is followed by MYR2,700 round figure.

Source: RHB Securities Research - 30 Jul 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024